I just finished reading Andrew Ross Sorkin’s Too Big To Fail, and I know that I really shouldn’t complain about it. As a first draft of history kind of thing, it’s spectacularly good, with almost mind boggling amounts of detail about what went down during mid-September of 2008. Within the tick-tock genre, it’s a real public service. The problem is that it’s also a Woodwardesque effort that leaves you guessing who his sources are and what axes they have to grind. Sometimes, though, his sources are pretty obvious, and the narrative suddenly stops dead for a pandering little soliloquy like this one. Its star is Morgan Stanley CEO John Mack at the height of the crisis:

I just finished reading Andrew Ross Sorkin’s Too Big To Fail, and I know that I really shouldn’t complain about it. As a first draft of history kind of thing, it’s spectacularly good, with almost mind boggling amounts of detail about what went down during mid-September of 2008. Within the tick-tock genre, it’s a real public service. The problem is that it’s also a Woodwardesque effort that leaves you guessing who his sources are and what axes they have to grind. Sometimes, though, his sources are pretty obvious, and the narrative suddenly stops dead for a pandering little soliloquy like this one. Its star is Morgan Stanley CEO John Mack at the height of the crisis:

He needed some air, he told [his wife], and decided to go on a walk. As he roamed up Madison Avenue, he realized that his entire adult life, his entire professional career was on the line. He had been in battles before — his losing fight with the firm’s former CEO, Philip J. Purcell, had been a notable one — but never anything like what he faced now. But this was not just about his personal survival; it was about the fifty thousand people around the globe who worked for him, and for whom he he felt a keen sense of responsibility. Images of Lehman employees streaming out of their building the previous Sunday still haunted him. He needed to buck up. Somehow, he was going to save Morgan Stanley.

And then he slid down the batpole to the batcave and got to work! Give me a break.

That aside, what else have I learned from the book? Apparently everyone on Wall Street really does watch CNBC 24/7. Tim Geithner doesn’t come out of this affair looking very good. I guess he didn’t cooperate with Sorkin. Jamie Dimon, on the other hand, does emerge as a good guy. I guess he did cooperate. And the biggest, clearest lesson of all: no one really had any idea what was going on last September. The whole thing was just massive confusion from beginning to end. By the time I was finished with the book, I couldn’t tell whether I felt more or less sorry for all these guys.

POSTSCRIPT: Plus this: the downside of insta-books is lousy copy editing. Somebody should be fired over the number of egregious typos in this book.

the good stuff is all substantive, while the bad stuff, with one exception, is all about optics and atmospherics. Do these lists really add up to an equal amount of good and bad?

the good stuff is all substantive, while the bad stuff, with one exception, is all about optics and atmospherics. Do these lists really add up to an equal amount of good and bad?

And now it’s online, so you can read it too! It starts with a bit of background: the collapse of Long Term Capital Management in 1998

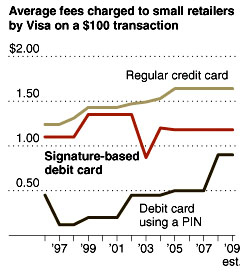

And now it’s online, so you can read it too! It starts with a bit of background: the collapse of Long Term Capital Management in 1998  volume has gone way up, and electronic payment networks boast the ultimate in economies of scale. So not only is Visa now charging a dime per transaction like the other guys, they’re probably only charging a few pennies. Right?

volume has gone way up, and electronic payment networks boast the ultimate in economies of scale. So not only is Visa now charging a dime per transaction like the other guys, they’re probably only charging a few pennies. Right? Ben Bernanke is famous as the originator of the theory of the

Ben Bernanke is famous as the originator of the theory of the  tone from the all-or-nothing days of the Bush administration. He is committed to taking aggressive actions to disrupt terrorist cells, aides said, but he also considers his speech in Cairo to the Islamic world in June central to his efforts to combat terrorism. “If you asked him what are the most important things he’s done to fight terrorism in his first year, he would put Cairo in the top three,” Rahm Emanuel, his chief of staff, told me.

tone from the all-or-nothing days of the Bush administration. He is committed to taking aggressive actions to disrupt terrorist cells, aides said, but he also considers his speech in Cairo to the Islamic world in June central to his efforts to combat terrorism. “If you asked him what are the most important things he’s done to fight terrorism in his first year, he would put Cairo in the top three,” Rahm Emanuel, his chief of staff, told me.