Over at Free Exchange, A.S. asks, “Are the rich making you poor?” Apparently not:

Talented traders and portfolio managers do make an obscene amount of money while other traders just get rich….The winner-takes-all nature of finance explains the income disparity within the industry. But it does not mean a Wall Street fat cat is getting rich at the expense of a more naïve investor whose stock holdings are limited to the mutual fund his 401(k) is in. The only thing that naïve investor is betting on is that the American economy will continue to grow and that companies will be profitable in the long run. Speculators actually can do this naïve investor a service. They can eliminate mispricing, promote efficiency, and provide market liquidity; this can enhance growth in the long run.

Well then, I have to ask yet again: where is this tsunami of money coming from? If financiers receive a greater fraction of national income than they did in the past, somebody else is getting less. That somebody is almost certainly you and  me, whose wages haven’t kept up with economic growth, thus creating a huge and growing pool of extra money for the financiers to hoover up.

me, whose wages haven’t kept up with economic growth, thus creating a huge and growing pool of extra money for the financiers to hoover up.

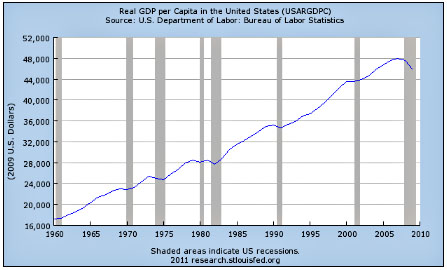

The only other alternative is that the modern financial sector is actually creating wealth that otherwise wouldn’t be created. That is, their magic has caused the economy to grow faster, and they’re merely reaping the benefits of growth they themselves are responsible for. I imagine this is a popular explanation among Wall Street bankers themselves, but does anyone else buy it? If it were true, surely it would show up in accelerated growth rates starting around 1980. Right?