I’m back. But I’ve been busy catching up on crossword puzzles this morning, and either this week’s puzzles were harder than usual or else my brain is slowly decaying, because they took me a while to finish. Probably the latter.

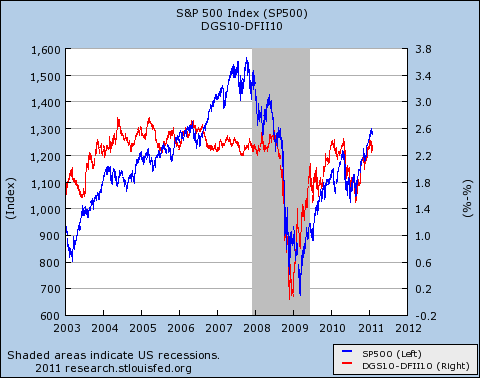

And speaking of brain decay, before I left I posted a chart showing that, starting in 2008, inflation expectations suddenly started to correlate really well with stock market prices. Scott Sumner and Paul Krugman say this demonstrates that our sluggish economy is due to a slowdown in aggregate demand,  and although I’m happy to believe this, it wasn’t clear to me why this correlation had anything to do with aggregate demand. So I asked for help.

and although I’m happy to believe this, it wasn’t clear to me why this correlation had anything to do with aggregate demand. So I asked for help.

Unfortunately, two posts were waiting for me when I got home, each disagreeing with the other. Here’s a nickel summary:

Kash: Normally, high inflation leads to high corporate profits, which makes investors happy. But they also realize that high inflation will cause the Fed to raise interest rates and this will slow growth. So they’re also unhappy, and these two reactions cancel out. However, when interest rates are at zero and the Fed has made it clear they aren’t going to raise them, there’s nothing to be afraid of. So higher inflation is a purely good thing, and therefore high inflation expectations lead to high stock market growth.

In other words, this doesn’t have anything to do with aggregate demand. It’s merely a reaction to the fact that interest rates are at zero and everyone knows they aren’t going up anytime soon.

Karl Smith: Normally, inflation expectations are just inflation expectations. They don’t really affect the underlying productive capacity of the economy, so investors react neutrally. However, in 2008 the stock market suddenly started reacting positively to inflation expectations. Why? If it wasn’t because anyone thought it would affect the underlying capacity of the economy, it must have been a reaction to the Fed’s announcement that it planned to print more money — and the only effect of printing more money is to induce people to buy more stuff.

In other words, investors were convinced that the economy’s problem was a lack of demand, and printing more money (and therefore causing more inflation) would increase demand and fix things up. So whenever inflation went up, the stock market went up.

I score this one for Karl. Kash’s explanation seems incomplete: After all, if investors think high inflation will genuinely lead to high corporate profits, not just a rise in the overall price level, they must think those profits are going to come from increased consumer demand for the stuff corporations are making. So they must be associating inflation with increased demand.

Plus Karl frames his answer in the form of an amusing Socratic dialog, so he gets points for that too. In any case, I’ve linked to both arguments, so you can read them for yourself. Like Glenn Beck, I insist that you do your own homework and not take my word for anything.