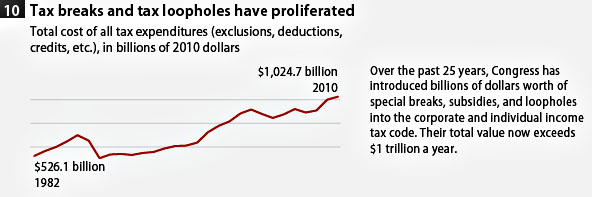

Matt Yglesias points to a chart from his CAP colleagues showing a dramatic increase in tax credits and deductions since 1982 and comments, “It’s not a good trend. Simpler taxes and efforts to do a more straightforward consideration of what is and isn’t worth spending money on are a much better idea.” Here’s the chart:

I’m not here to defend tax complification, and I’d like to see some of these tax expenditures cut back too. Still, I call foul. The usual way to measure this stuff is as a percent of GDP, and real GDP has increased from roughly $6.5 trillion in 1982 to $14.7 trillion in 2010. This means that as a percentage of GDP, tax expenditures have fallen from 8.1% to 7.0%. It would be nice for them to fall even further, but not because there’s been an explosion in tax expenditure revenue over the past three decades. There hasn’t been.1

However, CAP’s presentation has ten charts in it, and charts 1-9 are pretty good. It’s worth a click.

1Actually, this is kind of odd. The three biggest tax expenditures are the exclusion of employer contributions to employee healthcare plans, the mortgage interest deduction, and the exclusion of pension contributions. These are all pretty fast growing areas, and in addition lots of smaller tax expenditures have been added to the tax code since 1982. Given all this, I’m surprised tax expenditure revenue hasn’t grown faster.

UPDATE: I’ve revised the GDP numbers in the text. I used the real GDP series from the BEA, but forgot that it’s in 2005 dollars. I’ve adjusted it to 2010 dollars so it’s in the same units CAP uses for tax expenditures.

You could also do this as a percentage of federal revenue rather than a percentage of GDP. If you do it this way the relative size of tax expenditures has indeed gone up (from about 40% to 48%), though some of that is an artifact of the plunge in tax revenue following the 2008 recession.