The FT’s Neil Hume quotes Harvinder Sian of the Royal Bank of Scotland:

The FT’s Neil Hume quotes Harvinder Sian of the Royal Bank of Scotland:

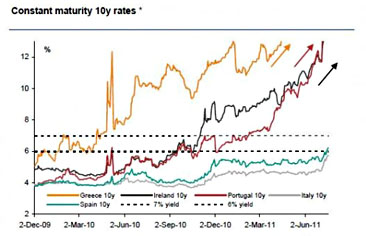

Spain has entered the danger zone for yield levels. The chart below shows the yield moves in the constant maturity 10y paper for the GIIPS countries. These markets traded a range between 6 per cent and 7 per cent but ultimately this proved to be a pause before the move to higher yields then accelerated. There is no consistent yield trigger level inside this range but market talk of point-of-no-return around the 6 ½% is not without foundation either.

….The conditions for a near death experience for the Euro are in place now, which in turn should finally galvanise a more serious policy reaction. In the interim, risk assets can be crushed.

This is not, repeat not, a good time to be screwing around with the possibility of defaulting on U.S. debt. Repeat: not, not, not. It’s time for the Republican leadership to start facing reality and getting their troops in line. Playtime is over.