Matt Yglesias is annoyed at President Obama for repeatedly saying that the rise of ATM machines has reduced the number of bank tellers. In fact, the number of bank tellers and the number of ATMs has gone up over the past decade.  In 1999 American banks employed 1.62 tellers per 1000 people, and by the peak pre-recession year of 2007 that had gone up to 2.02 per 1000.

In 1999 American banks employed 1.62 tellers per 1000 people, and by the peak pre-recession year of 2007 that had gone up to 2.02 per 1000.

So Obama is wrong about this. But what I’m really curious about is something else: What are all these tellers doing? It’s easy for me to believe that ATMs didn’t reduce our need for tellers, but instead simply increased the number of banking transactions we engage in. Instead of carefully figuring out how much money we need every week or two, we just go to the ATM whenever we run low. So instead of two or three withdrawals a month, we all now pull money out of the bank two or three times a week. The effect on tellers might be pretty small.

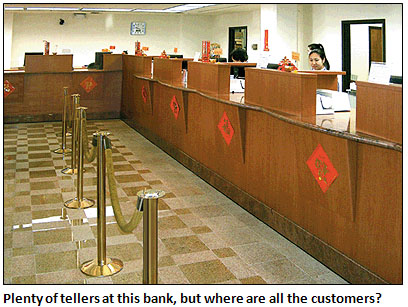

But even if that’s true (and I’m just guessing), why do we need more tellers? What are they all doing? My local bank is just a single data point, but one possibility is: nothing. Thirty years ago, when I went to the bank to do something, I had to wait in line. Not anymore! My Wells Fargo branch always has three or four tellers available, and the modal number of people waiting in line is zero. Most of the time, you just walk up to a teller and do your business.

This is great for me, of course, but frankly doesn’t seem like a profit-maximizing strategy for Wells Fargo. Do I have any bank manager readers who can provide some insight into this? Is my branch unusual? Are tellers busy with other work when they aren’t helping customers? Has the average teller transaction gotten more complex over the past decade? What’s the story here?