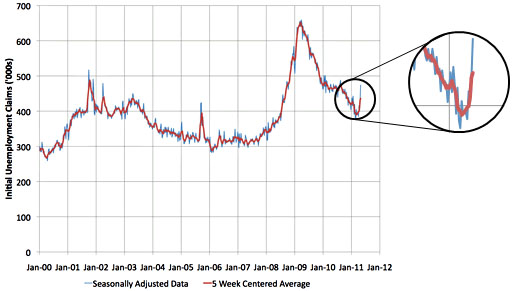

So, um, we had a rough day in the commodity markets:

So, um, we had a rough day in the commodity markets:

A surging dollar and a collapse in oil prices roiled commodity markets, as fears grow that high costs for energy and raw materials are undermining the global economic recovery….That lack of confidence was pivotal in spurring a hectic retreat by investors who had bought commodities—particularly silver and oil—as a hedge against a steadily weakening dollar.

The New York Times elaborates:

“Pop goes the bubble,” said Michael Lynch, president of Strategic Energy and Economic Research, a consulting firm. “It seems unlikely you will see any tightening in the market in the coming months. The worst of the political threats have passed us.”

….For the day, crude oil for June delivery tumbled $9.44 a barrel, or 8.6 percent, to settle at $99.80 in New York trading. Almost all commodities prices took a tumble on Thursday. Gold for June delivery dropped 2.2 percent, or $33.90, to $1,481.40 an ounce, while silver lost 8 percent or $3.148, to $36.24 an ounce. Other metals — including nickel, copper, palladium and platinum — all fell sharply. Coffee, corn, cotton, wheal and soybeans also dropped.

There’s a sense in which this is almost good news. If the oil/commodity bubble pops now, it will cause some damage but it will probably be manageable. But if it had gone on for another six months or a year, the damage to the global economy could have been much greater.

This is only a few days worth of data, so take it with a grain of salt. Still, it does make you wonder if we really do have a global economy these days that’s inherently built on bubbles of one kind or another. Our financial rocket scientists seem almost incapable of making money in a normal economy — making enough money to satisfy themselves, anyway — so instead they spend their time seeking out smallish bubbles and then working overtime to supercharge them enough to spin out some temporary wealth before everything crashes back down to earth. One of these days we might actually get serious about regulating leverage enough to slow this down, but it hasn’t happened yet. Maybe another half dozen bubbles will finally do the trick.

bunch of shots in a row sometimes? Their conclusion was clear: there’s no such thing as hot hands. But athletes themselves, even really smart, analytical ones, have never been able to accept this. They know the feeling of being hot, and no pointy-eared academics can tell them otherwise. I once had a (really smart) boss who felt that way, for example, and

bunch of shots in a row sometimes? Their conclusion was clear: there’s no such thing as hot hands. But athletes themselves, even really smart, analytical ones, have never been able to accept this. They know the feeling of being hot, and no pointy-eared academics can tell them otherwise. I once had a (really smart) boss who felt that way, for example, and

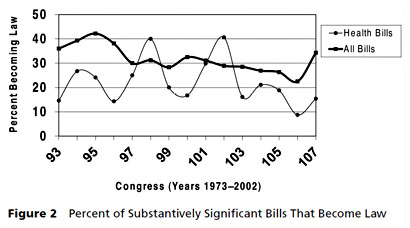

Jon Cohn

Jon Cohn  OCD or (b) massive maltreatment of grad students. I’m not sure which. But code them they have, and when they strip out all the trivial/symbolic/post office naming kinds of bills, they come to two conclusions:

OCD or (b) massive maltreatment of grad students. I’m not sure which. But code them they have, and when they strip out all the trivial/symbolic/post office naming kinds of bills, they come to two conclusions: reports,

reports,