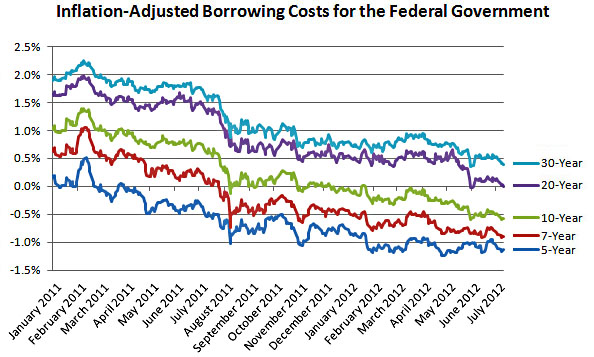

You really can’t make this point often enough, and today Ezra Klein makes it again: the federal government can currently borrow money for free. In fact, better than free: inflation-adjusted rates on treasury bonds are negative for maturities of ten years or less, and damn close to negative even for longer-term bills:

Negative! The market will literally pay us a small premium to take their money and keep it safe for them for five, seven or 10 years. We could use that money to rebuild our roads and water filtration systems. We could use that money to cut taxes for any business that adds to its payrolls. We could use that to hire back the 600,000 state and local workers we’ve laid off in the last few years.

Or, as Larry Summers has written, we could simply accelerate payments we know we’ll need to make anyway. We could move up maintenance projects, replace our military equipment or buy space we’re currently leasing. All of that would leave the government in a better fiscal position going forward, not to mention help the economy.

The fact that we’re not doing any of this isn’t just a lost opportunity. It’s financial mismanagement on an epic scale.

Yep. It’s worth noting that this money isn’t literally free. We still have to pay it back eventually. But we’d have to pay back less than we borrowed in the first place. So we could borrow a billion dollars to build a water filtration system, get the use of that system for ten years, and then pay back $900 million. It’s an incredible bargain.

This logic applies to pretty much any project we think we’re going to need eventually. If we’ll need it someday, the best time to build it is now, when the rest of the world will help finance it for us. This would put people to work, build some critical infrastructure, and effectively do it for less than market prices. What’s not to like?

If you’re curious, real treasury yields since 2011 are shown in the chart below. 5-year rates went negative in February 2011; 7-year rates went negative in July; 10-year rates went negative in December; and 20-year rates went to zero today. Only 30-year rates are still positive, but just barely.