What’s the benefit of being a gigantic bank? Well, for one thing, everyone assumes that if you get into trouble you’ll get bailed out by the feds. That makes you safer, and that in turn means you have lower borrowing costs. Bloomberg editors, keying off an IMF report from last year,  figure that this implicit subsidy amounts to about 0.8 percent per year:

figure that this implicit subsidy amounts to about 0.8 percent per year:

Small as it might sound, 0.8 percentage point makes a big difference. Multiplied by the total liabilities of the 10 largest U.S. banks by assets, it amounts to a taxpayer subsidy of $83 billion a year. To put the figure in perspective, it’s tantamount to the government giving the banks about 3 cents of every tax dollar collected.

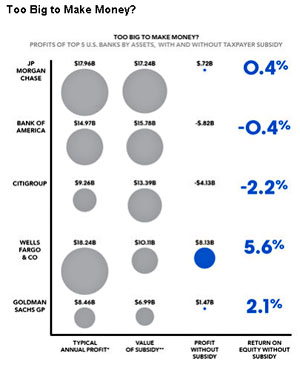

The top five banks — JPMorgan, Bank of America Corp., Citigroup Inc., Wells Fargo & Co. and Goldman Sachs Group Inc. — account for $64 billion of the total subsidy, an amount roughly equal to their typical annual profits (see tables for data on individual banks). In other words, the banks occupying the commanding heights of the U.S. financial industry — with almost $9 trillion in assets, more than half the size of the U.S. economy — would just about break even in the absence of corporate welfare. In large part, the profits they report are essentially transfers from taxpayers to their shareholders.

The chart above shows this graphically. With the exception of Wells Fargo, the biggest banks in America would all be essentially profitless if it weren’t for the implicit subsidy that being Too Big To Fail gives them.

Bloomberg recommends that this situation be addressed by requiring big banks to hold far more capital than they do now; putting an end to all speculative trading; and requiring bondholders to take losses when banks run into trouble. These are good ideas, but the latter two, especially, are hard to implement reliably. But there’s a fourth option: split up the banks. If they’re too big to fail, and everyone knows it, the only real answer is to make them small enough that they can fail. Creditors would then take care of all the rest.