A couple of weeks I put up a post showing projections of future retirement income, but these were long-term projections and didn’t provide any insight into the specific effect of the Great Recession on those who are currently nearing retirement. There are two big things we’re interested in: (a) the effect on retirement savings [401(k)s, IRAs, etc], and (b) debt levels as a percent of income. EBRI provided some rough data on the former here, and today they provide us with a look at the latter. Here’s their quick summary for all families with a head of household over 55:

The percentage of American families with heads age 55 or older that have debt held steady at around 63 percent from 2007–2010. Furthermore, the percentage of these families with debt payments greater than 40 percent of income—a traditional threshold measure of debt load trouble—decreased in 2010 to 8.5 percent from 9.9 percent in 2007. However, total debt payments as a percentage of income increased from 10.8 percent in 2007 to 11.4 percent in 2010.

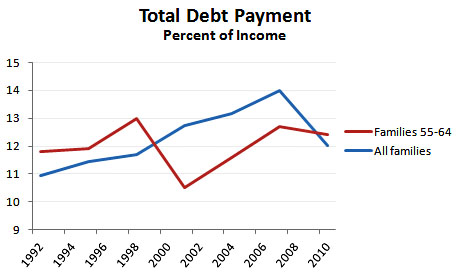

This includes both near-retirees and retirees. In order to get a clearer look just at people nearing retirement, the chart below shows debt payments for families with a head of household age 55-64 (red line). As a comparison, it also shows debt payment levels for all families, taken from Fed data (blue line):

There’s much more in the full report, including data on families already in retirement, as well as breakdowns between housing debt and other consumer debt.