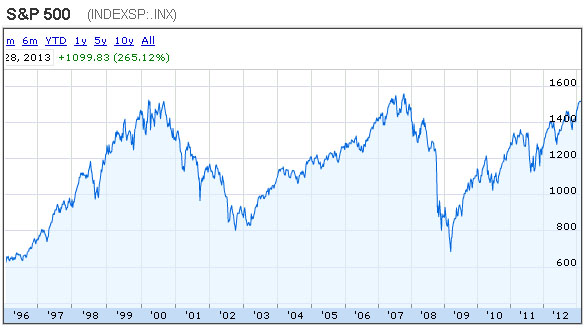

Matt Yglesias says the Dow Jones Industrial Average is a dumb way to measure the stock market because it’s weighted by price instead of by market cap. True enough. But as he also points out, it’s carefully constructed to mimic properly constructed indexes, so it’s not that bad, really. Still, if you want to see how the stock market is really doing, the S&P 500 is a better bet. And guess what? It’s getting close to its all-time high too, just like the Dow.

In real terms, this isn’t very impressive, since it means that if you bought a share in an S&P 500 index fund in 1998, it would have produced about zero return over the past 15 years in inflation-adjusted terms. Still, growth is growth. For everyone near retirement who saw the value of their 401(k) plummet during the financial crash, you’ve made up most of what you lost. It would be nicer if you’d also seen some growth in your assets, but at least you’re not too far in the hole anymore.