Today, you should give thanks that you aren’t the attorney who has to defend Standard & Poor’s from charges that it misled investors about the objectivity of its bond ratings. Here’s their defense:

It’s true that courts have long allowed sellers to engage in what’s called “puffery.” If McDonald’s says they make the world’s best hamburgers, that’s OK. It may be a ridiculous claim, but what do you expect them to say? “Our burgers are pretty good if nothing else is available”? Basically, you’re allowed to make vague claims about your greatness without inviting lawsuits from folks who don’t like your burgers.

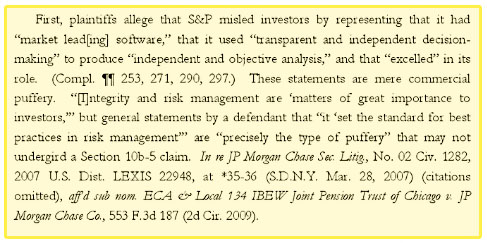

So when S&P says they use “market leading software,” they’re probably on firm ground. That’s standard puffery. Unfortunately, “transparent,” “independent,” and “objective” are a little trickier. Those words have actual meaning, and there’s only so far you’re allowed to stretch them. When your bond ratings are secretly based on the fact that bond issuers are paying you heaps of money for inflated scores, your claims of mere puffery are a lot less likely to succeed.

But hey! There’s no harm in trying. Well, there’s no harm aside from the endless mockery this defense is producing. After all, S&P is basically saying, sure, our ratings are completely meaningless because we just produce whatever rating the bond issuer pays us for, but everyone already knows that. Only a fool would ever have believed anything else.

Should be a fun trial.