In the case of former Goldman Sachs trader Fabrice Tourre, the U.S. government was able to secure only a weak civil judgment. But in the case of former Goldman Sachs programmer Sergei Aleynikov, the U.S. government succeeded in winning a sentence of eight years in prison even though their case was so weak it was overturned almost immediately on appeal. What was the difference? After reading Michael Lewis’ Vanity Fair piece on Aleynikov, Felix Salmon explains:

The big difference between the two cases is that while Tourre was defended by Goldman Sachs, Aleynikov was prosecuted by them: Lewis leaves the reader in no doubt that the decision to prosecute, along with all the supporting arguments, while nominally taken by the FBI, was essentially made by Goldman Sachs itself. The irony is painful: the government, acting against Goldman Sachs, could only manage a civil prosecution. But Goldman Sachs, acting through the government, managed to secure itself a highly-dubious criminal prosecution, complete with an eight-year prison sentence.

Lewis doesn’t delve too deeply into the jurisprudence here. But it’s obvious that the case would never have been brought without Goldman’s aggressive attempt to cause as much personal destruction as possible to Aleynikov.

Emphasis mine. Aleynikov is not 100 percent innocent in this case. He’s close, though. And even now, after his sentence has been overturned, Goldman Sachs has managed to continue its persecution of Aleynikov by getting the Manhattan D.A.’s office to arrest him on some brand new charges, for no apparent reason except to make sure the guy has a criminal record. (He’s already served enough time that he wouldn’t return to prison even if he were convicted.)

So there you have it. In a nutshell, these two cases tell you who really runs things here in the land of the free. Both Lewis’s article and Salmon’s summary are well worth a few minutes of your time.

there’s no real need to pretend to take it seriously.)

there’s no real need to pretend to take it seriously.)

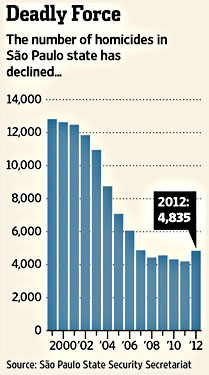

oil. Brazil started its gasoline substitution program in 1975, and began large-scale production of E95 (lead-free) fuel ethanol for vehicles running on straight alcohol in 1979. By 1984, E95 fuel accounted for almost one-third of all vehicle fuel in Brazil, and E95 accounted for almost half of all vehicle fuel in Brazil in 1987.

oil. Brazil started its gasoline substitution program in 1975, and began large-scale production of E95 (lead-free) fuel ethanol for vehicles running on straight alcohol in 1979. By 1984, E95 fuel accounted for almost one-third of all vehicle fuel in Brazil, and E95 accounted for almost half of all vehicle fuel in Brazil in 1987.

backpacks, and her son had been googling for news about the Boston bombings. This raised some red flags and produced the JTTF visit.

backpacks, and her son had been googling for news about the Boston bombings. This raised some red flags and produced the JTTF visit.