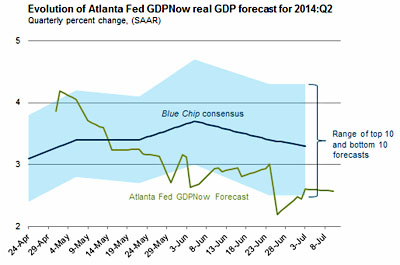

Via James Hamilton, the Atlanta Fed is now making its GDP forecasts publicly available. As you can see, they’ve gotten steadily more pessimistic since April and are now predicting a growth rate of 2.6 percent in the second quarter.

Via James Hamilton, the Atlanta Fed is now making its GDP forecasts publicly available. As you can see, they’ve gotten steadily more pessimistic since April and are now predicting a growth rate of 2.6 percent in the second quarter.

Now, there are two way to look at this. The glass-half-full view is: Whew! That huge GDP drop in Q1 really was a bit of a blip, not an omen of a coming recession. The economy isn’t setting records or anything, but it’s back on track.

The glass-half-empty view is: Yikes! If the dismal Q1 number had really been a blip, perhaps caused by bad weather, we’d expect to see makeup growth in Q2. But we’re seeing nothing of the sort. We lost a huge chunk of productive capacity in Q1 and apparently we’re not getting it back. From a lower starting level, we’re just going to continue along the same old sluggish growth path that we’ve had for the past few years. All told, GDP in the entire first half of 2014 hasn’t grown by a dime.

I am, by nature, a glass-half-empty kind of person, so feel free to write off my pessimism about this. Nonetheless, the GHE view sure seems like the right one to me. It’s just horrible news if it turns out that during a “recovery” we can experience a massive drop in GDP and then do nothing to make up for it over the next quarter. It’s even worse news that the unemployment rate is going down at the same time. I know that last month’s jobs report was relatively positive, but in the longer view, how can unemployment decrease while GDP is flat or slightly down? Not by truly decreasing, I think. It happens only because there’s a growing number of people who are permanently left behind by the economy and fall out of the official statistics.

But hey. This is just a forecast. Maybe the Atlanta Fed is wrong. We’ll find out in a couple of weeks.