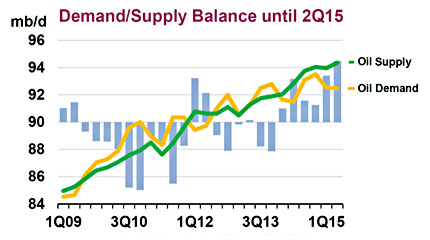

I don’t have a lot to say about this, but I wanted to pass along this chart from Chris Mooney over at Wonkblog. Basically, it shows that although both supply and demand for oil have been roughly in sync for the past five years, demand abruptly dropped earlier this year and is projected to stay low next year. This is why prices have dropped so far: not because supply has skyrocketed thanks to fracking—the supply trendline is actually fairly smooth—but because the world is using less oil.

I don’t have a lot to say about this, but I wanted to pass along this chart from Chris Mooney over at Wonkblog. Basically, it shows that although both supply and demand for oil have been roughly in sync for the past five years, demand abruptly dropped earlier this year and is projected to stay low next year. This is why prices have dropped so far: not because supply has skyrocketed thanks to fracking—the supply trendline is actually fairly smooth—but because the world is using less oil.

This is a short-term blip, and I don’t want to make too much of it. Still, regular readers will remember that one of the biggest problems with oil isn’t high prices per se. The world can actually get along OK with high oil prices. The problem is spikes in oil prices caused by sudden imbalances between supply and demand. Historically this wasn’t a big problem because potential supply was much higher than demand. If demand went up, the Saudis and others just opened up the taps a bit and everything was back in balance.

But that hasn’t been true for a while. There’s very little excess capacity these days, so if oil supply drops due to war or natural disaster, it can result in a very sudden spike in prices. And that can lead to economic chaos. But if demand has fallen significantly below supply, it means we now have excess capacity again. And if we have excess capacity, it means that the price of oil can be managed. It will still go up and down, but it’s less likely to unexpectedly spike upward. And this in turn means that, at least in the near future, oil is unlikely to derail the economic recovery. It’s a small but meaningful piece of good news.