A new paper investigates the association between income inequality and recessions over the past 40 years:

It would appear that a less equal income distribution leads to deeper and more costly recessions. Overall, the length of the duration of contraction when going into a recession is longer and its amplitude deeper for countries with a less equal distribution of income.

But by how much? The authors use the World Bank’s GINI score and conclude that a one point increase in GINI leads to a 0.26 percent increase in the depth of a recession and a 0.2 percent increase in cumulative losses over the course of a recession. In other words, the effect is noticeable but not huge.

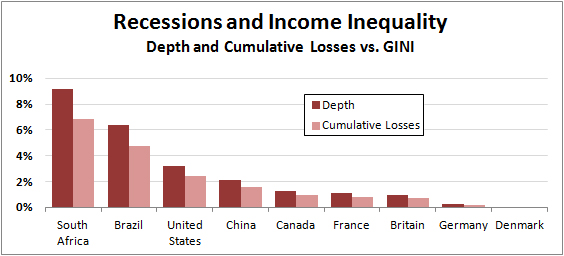

To make this a little more concrete, here’s a chart that shows how the authors would expect recessions in various countries to compare to a recession in Denmark, which has a very low GINI score. For the United States, other things equal, we should expect that our recessions would be about 3 percent deeper and produce 2 percent more losses than a recession in Denmark.