Tyler Cowen notes this morning that core inflation is now running around 2.3 percent, its highest rate since 2008. “As I’ve been saying, I see very little chance of an aggregate demand-based recession this year, the Fed’s December interest rate hike was not an obvious mistake, and we are not in any operative way in a liquidity trap right now.”

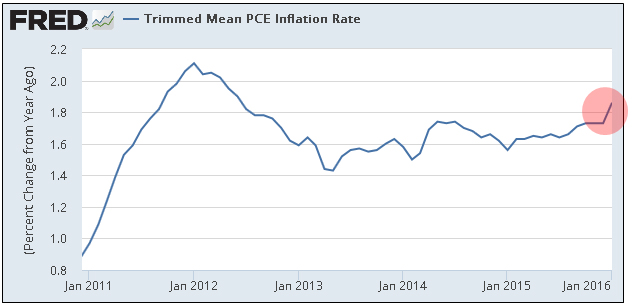

Perhaps so. But the Fed uses trimmed mean PCE as its preferred measure of inflation, and this hit 1.86 percent in January. True, it’s been drifting slightly upward for the past year, but so far the only sign of escalating inflation is a single month that’s about a tenth of a point higher than the average of the past couple of years. I’m happy to see the economy show signs of inflation, no matter how minuscule, but I’d probably wait a bit before drawing any conclusions from this. There’s no reason for the Fed to react in a panic every time inflation comes anywhere close to their target rate.