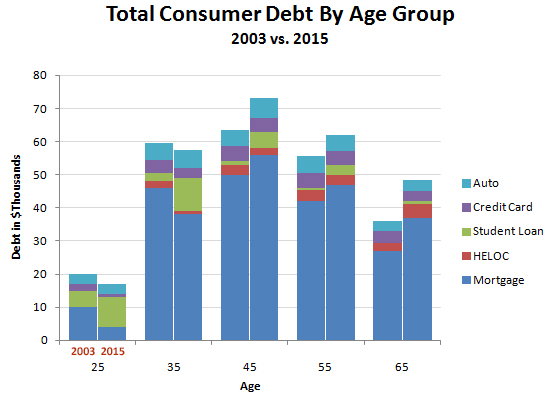

Ylan Mui points today to a February note from the New York Fed called “The Graying of American Debt.” Here’s the basic picture:

The student debt story is about what you’d expect: young consumers have more of it, but their total debt load is lower than it was in 2003 because they have lower mortgage debt. Basically, they’re trading student debt for mortgage debt.

But older age groups make up for it with higher debt than they had in 2003. This is especially true at age 65, where total debt is up by about a third over the past decade. So what does it all mean?

The close relationship between credit score and age…reflects an average credit history that is considerably stronger among older borrowers….Further, older borrowers’ income streams are comparatively stable, and they have greater experience with credit. Survey of Consumer Finances data show that net worth levels for households with heads who are age 65 and older in 2013 are quite similar to their 2004-07 levels. This holds despite the evidence, seen in the second chart in this post, that consumers are holding substantially more per capita debt at age 65 and beyond. If history is any guide, then, we expect older borrowers to make more reliable payments. Indeed, our data show no clear trend toward higher delinquency at older ages as average balances at older ages have increased.

Hence the aging of the American borrower bodes well for the stability of outstanding consumer loans. At the same time, the likely combination of muted credit access and lower demand for credit that we observe among our younger borrowers may well have consequences for growth. The graying of American debt that we observe between 2003 and 2015, then, might be interpreted as a shift toward greater balance sheet stability, and away from credit-fueled consumption growth.

More stability, less growth. Just what old people want. But is it good for the country?