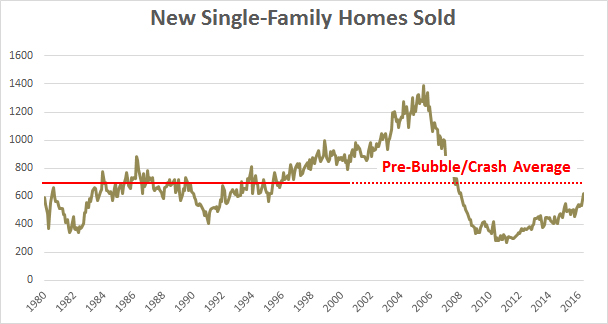

Well, maybe. April saw sales of 619,000 new single-family homes. This is starting to get very close to the average from 1980-2001, before the housing bubble and subsequent crash. At our current rate, we’ll exceed the old average by this time next year.

Is this good or bad? It’s nowhere near bubble territory, so it should be good. If people are buying new homes, it’s a sign not just that the economy is picking up (we already knew that), but that people are confident enough in the economy to tie themselves into 30-year mortgages at the same rate they did back when the economy was motoring along. So: two cheers for housing!