The Wall Street Journal always has the cheeriest news:

The Wall Street Journal always has the cheeriest news:

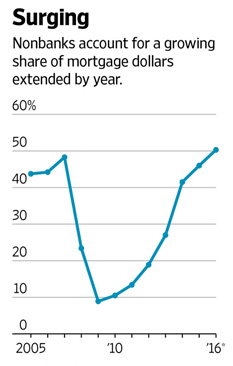

Banks no longer reign over the mortgage market. They accounted for less than half of the mortgage dollars extended to borrowers during the third quarter….Taking their place are nonbank lenders more willing to make riskier loans banks now shun.

….Many nonbanks are courting borrowers who can’t get approved by banks, which have favored customers with pristine credit….As nonbanks get bigger, some analysts are concerned about their ability to weather tougher economic times. Unlike banks, nonbanks don’t take in deposits and rely largely on financing—mostly from banks—to keep loan volume going.

….Some nonbank lenders say concerns about liquidity are overblown. “We are not taking on credit risk—the loss is borne by [government] agencies,” said Bob Walters, chief economist at Quicken Loans. “As long as there is a government guarantee, that is a powerful leveling factor that keeps the flow of funds going.”

On the one hand, it’s not like I want to panic every time home mortgages become marginally easier to get. On the other hand, well, you know. The Late Unpleasantness™ continues to weigh on my mind. This is why I take seriously Hillary Clinton’s promise to regulate shadow banking more rigorously. If we pass laws that tighten up the banking industry, the point is to tighten up the industry, not merely to shift risky business somewhere else.

So, sure, there’s probably no need to melt down over every minor change in the mortgage market. But it’s sure as hell worth paying attention to.