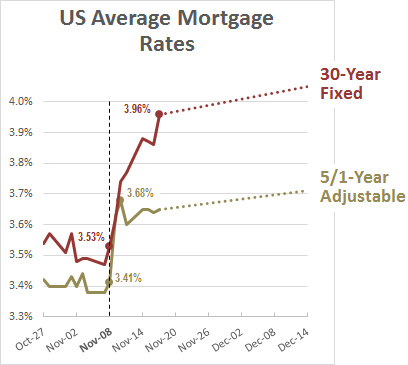

Matt Yglesias tweeted yesterday about mortgage interest rates going up after the election, and that got me curious about just how quickly they spiked upward after we all  learned that Donald Trump would be our next president. The chart on the right shows the answer: pretty darn quickly.

learned that Donald Trump would be our next president. The chart on the right shows the answer: pretty darn quickly.

On November 8, the average 30-year fixed mortgage was available at a rate of 3.53 percent. Within two days it had gone up 21 basis points, and within a week it had gone up 43 basis points. Adjustable mortgages spiked upward too, though not as dramatically, and both rates continued to drift upward until December 14. Then they spiked upward again thanks to the Fed’s decision to increase interest rates.

So what does this mean for your ordinary working-class joe who voted for Trump? Well, for a 30-year fixed mortgage on a $200,000 loan, the monthly payment has increased from about $900 to $950. That’s an extra $600 per year.

Generally speaking, this spike was due to the fact that everyone panicked after Trump won, causing treasury bond yields to jump 35 basis points in a week. More specifically, however, is it due to China selling US treasuries in greater quantities than usual? Maybe! But whatever the cause, if you waited until after the election to buy a house, you’re paying a pretty stiff Trump penalty.