You all may remember that back in 2000-01 Enron engineered an artificial shortage of electricity in California, which sent prices skyrocketing. This was a harrowing affair, and ever since then California has been building new power plants. And building. And building. And building some more.

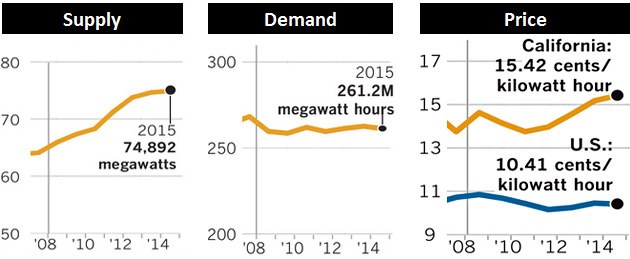

At the same time, demand for electricity declined after the Great Recession and then flattened out. But California kept building new plants anyway. As we all know, the result of higher supply and lower demand should be lower prices. However, as these three charts excerpted from the LA Times show, that’s not how things have worked out:

This seems inexplicable. Why have prices gone up? And why are California utilities continuing to build new power plants even as they’re mothballing recently built plants because there’s no need for them? Ivan Penn and Ryan Menezes explain:

California regulators have for years allowed power companies to go on a building spree, vastly expanding the potential electricity supply in the state. Indeed, even as electricity demand has fallen since 2008, California’s new plants have boosted its capacity enough to power all of the homes in a city the size of Los Angeles — six times over. Additional plants approved by regulators will begin producing more electricity in the next few years.

The missteps of regulators have been compounded by the self-interest of California utilities, Lynch and other critics contend. Utilities are typically guaranteed a rate of return of about 10.5% for the cost of each new plant regardless of need. This creates a major incentive to keep construction going: Utilities can make more money building new plants than by buying and reselling readily available electricity from existing plants run by competitors.

The over-abundance of electricity can be traced to poorly designed deregulation of the industry, which set the stage for blackouts during the energy crisis of 2000-2001….Instead of lowering electricity costs and spurring innovation, market manipulation by Enron Corp. and other energy traders helped send electricity prices soaring.

….State leaders, regulators and the utilities vowed never to be in that position again, prompting an all-out push to build more plants, both utility-owned and independent….By the time new plants began generating electricity, usage had begun a decline, in part because of the economic slowdown caused by the recession but also because of greater energy efficiency.

The state went from having too little to having way too much power.

“California has this tradition of astonishingly bad decisions,” said McCullough, the energy consultant. “They build and charge the ratepayers. There’s nothing dishonest about it. There’s nothing complicated. It’s just bad planning.”

There you have it. Econ 101 didn’t fail after all. Regulated utilities aren’t a real market economy, and California’s regulators have allowed epic overbuilding because of the trauma of the 2000 blackouts. Utilities have happily taken advantage of this because they make more money from building useless plants than they do from trading with other utilities.

Enron may be long dead, but its ghost lives on. California paid the price for Enron’s machinations in 2000, and now it’s paying the price again thanks to fear of another Enron happening someday. Plus we got Arnold Schwarzenegger out of the deal.1 It’s amazing how much damage a single greedy company can do.

1Schwarzenegger was elected in place of Gov. Gray Davis, who was recalled. But the recall was largely driven by anger over the blackouts and the subsequent rate increases. It never would have happened if not for the electricity crisis.