Christmas in California #2. Location: 17th and Linwood, Santa Ana.

Christmas in California #2. Location: 17th and Linwood, Santa Ana.

Gage Skidmore/Planet Pix via ZUMA

Well, the Republican tax bill is set to pass later today. You know the basics: it cuts corporate taxes permanently but cuts individual taxes only temporarily. It’s a pretty good deal for rich people, not so great for the middle class.

You may also know that we dodged some bullets. The tax on grad students got axed, for example. Likewise, Congress got cold feet at the last second about eliminating the Johnson Amendment, which bans churches from engaging in political activity.

But there are also some less savory provisions of the tax bill that you may not have heard of. Some of them have been there all along, while some got added at the last minute. Here’s a few of them:

Chained CPI

Republicans decided to use a new measure of inflation called chained CPI to calculate tax brackets. The problem is not that chained CPI is a lousy measure of inflation—it’s actually perfectly good—but that it works properly only if everything is measured using chained CPI. But everything isn’t. What this means in the real world is that people will get moved into higher tax brackets faster than before, and this will cost them a lot of money. Here’s the estimate from the Joint Committee on Taxation:

The JCT only projects things for ten years, but I’ve added projections for the next decade after that since chained CPI is a gift that keeps on giving. And it’s worth noting just how insidious this is. For the next few years no one will notice what’s happening because the impact is small and it’s covered up by the individual tax cuts in the bill. But those expire in eight years, just as the chained CPI provision really starts to pick up steam. This means that only after 2025 will middle-class taxpayers get hit with the full cost of the chained CPI provision. By 2037 it amounts to more than $100 billion, or roughly $1,000 per household.

So who wanted this, anyway? It’s been a Republican hobbyhorse for years as a stealth way of raising money to pay for tax cuts. This year, they finally did it.

Real-Estate Partnerships

At the last minute, a provision was added that dramatically reduced taxes on certain kinds of real-estate partnerships. Why? Sen. John Cornyn, who’s in charge of rounding up support for Republican bills, said it was inserted in order to “cobble together the votes we needed to get this bill passed.”

So who wanted this, anyway? That’s a surprisingly difficult question to answer. So far, no one has taken credit for this provision, but apparently it was added by Cornyn himself. As for who it benefits, the obvious answer is that it benefits anyone with large real-estate interests. For example, one of the votes that Cornyn needed to “cobble together” came from Sen. Bob Corker, who was dead set against the tax bill because it increased the deficit, but then suddenly changed his mind after this provision was added. By coincidence, the new rules will likely save him millions of dollars in taxes on his real-estate empire.

Anyone else of note? Well, there’s the guy who has to sign the tax bill into law: Donald Trump. It’s going to save him a bundle.

Carried Interest

This is not something that was added to the bill, but something that wasn’t. Like a zombie that just won’t die, the carried-interest loophole has survived yet again—despite the fact that President Trump campaigned repeatedly on eliminating it. Hedge fund billionaires across the country breathed another sigh of relief.

So who wanted this, anyway? Hedge funds and private equity managers, primarily. Despite Trump’s big talk, in the end no one wanted to anger folks who have billions of dollars in ready cash available for political contributions.

Alimony

Alimony payments are no longer deductible. This is, fundamentally, a tax on divorce (explanation here).

So who wanted this, anyway? Maybe evangelicals, who think divorce is sinful? It’s something of a mystery, since this provision raises only a pittance. In any case, it’s going to cost a bunch of middle-class ex-couples a lot of money.

Estate Tax

The estate tax exemption was raised to $11 million per person or $22 million per couple. You probably knew that. But there’s more.

First, that exemption amount is now indexed to inflation. When it comes to things like the minimum wage, Republicans flatly refuse to consider inflation indexing. But for millionaires and their heirs? Why of course we have to index.

Second, the bill provides a truly massive and inexplicable gift to heirs of the rich. Suppose you inherit some Apple stock that’s increased in value from $1 million to $30 million. Donald Trump’s 2016 campaign tax plan would have exempted the first $22 million, but then you’d have to pay capital gains taxes on the remaining $8 million. In other words, you had to pay taxes on something. Not anymore, though. Not only has the estate tax been eliminated for estates under $22 million, but the Republican bill keeps the current “step-up” law, which means assets are automatically revalued upon death and no capital gains taxes are due. If dad sells off his holdings himself, he has to pay capital gains on the profit. But if he dies and you sell it, you’re free and clear. Even the biggest proponents of killing the estate tax never imagined a gift this brazen.

So who wanted this, anyway? You don’t have to ask, do you? This has been an obsession of the ultra-wealthy for decades. They have long loathed the fact that they can’t control their fortunes even in death, and they loathe it even more that the federal government will get a cut of their hard-earned riches. With this tax bill, they have almost reached their goal of eliminating not just the estate tax, but taxes of any kind on their accumulated wealth.

37% tax rate for millionaires

At the last minute, Republicans decided that the super-rich deserved more of a break than they were already getting: the tax rate on income over $1 million was cut from 39.6 percent to 37 percent. Just for the record, an income of $1 million puts you above the top 1 percent. It’s somewhere around the top 0.3 percent.

So who wanted this, anyway? Rich people. Duh.

Cultura/ZUMAPRESS

The New York Times reports that the IRS is in trouble:

Even before Congress began revising the tax code, the I.R.S. was struggling to keep up with an expanding workload. Since 2010, its budget has been cut by $900 million — or 17 percent, after adjusting for inflation — and its staff reduced by 21,000, or 23 percent. In the meantime, it has had to process roughly 10 million more individual returns.

The agency has been a favorite target of Republicans, who have complained that it unfairly investigated conservative organizations and reveled in irritating taxpayers. (A recent inspector general report showed that the I.R.S. had scrutinized both liberal and conservative groups.) During the campaign, President Trump accused the agency of unjustly hounding him with audits year after year. Paying as little as possible was “the American way,” he declared.

Although Treasury Secretary Steven Mnuchin has acknowledged the importance of sufficiently funding the nation’s revenue collector, Mr. Trump’s budget proposed deep cuts.

The gist of the story is that the IRS will have big problems figuring out the Republicans’ shiny new tax code while they’re already overwhelmed with routine work. But I suspect that’s a feature, not a bug. It means that not only do corporations get a big tax cut, but they can push the envelope of the new rules as hard as they want without much fear that the IRS can push back. Reducing audits on rich people is, generally, the reason for the continuing evisceration of the IRS, and this just fits the pattern.

Oh, and why did I highlight that sentence in the second paragraph? Just to show how easy it is to make sure readers know the truth. Compare that to a recent story in the Washington Post:

Years of conservative attacks on the Internal Revenue Service have greatly diminished the ability of agency regulators to oversee political activity by charities and other nonprofits, documents and interviews show….They capitalized on revelations in 2013 that IRS officials focused inappropriately on tea party and other conservative groups based on their names and policy positions, rather than on their political activity, in assessing their applications for tax-exempt status….Conservatives have likened the IRS’s extra scrutiny of the tea party groups to Watergate and called it a political witch hunt….By early 2012, tea party groups across the country were growing frustrated by the delays, some stretching to two years or more. Some activists bristled that IRS officials had sent them intrusive, wide-ranging requests for more information about political affiliations, social media posts and other details….The IG’s report was released in May 2013, triggering an uproar. It concluded that IRS officials “used inappropriate criteria that identified for review Tea Party and other organizations,” based on names or policy positions rather than an assessment of the groups’ political activity.

It is not until the 50th (!) paragraph that reporter Robert O’Harrow Jr. gets around to mentioning that liberal groups were also targeted. If you don’t manage to make it that far, you’ll leave with the impression that the IRS really did specifically target conservative groups unfairly, even though the evidence is now clear that nothing of the sort happened. What’s up with that?

Corporate CEOs have already made it plain that a tax cut won’t prompt them to hire more or invest more. They already have lots of money, and if they wanted to expand they’d have already done it. Instead, the tax cut will go toward increased dividends and bigger stock buybacks, which mostly benefit wealthy shareholders.

In fact, according to Senate Democrats, they’re already making good on this promise. Over the past three years, stock buybacks have been pretty steady at a rate of roughly $1-2 billion per day. But ever since the Senate passed the tax bill, making its final enactment almost certain, stock buybacks have skyrocketed:

This does exactly nothing to help the economy or employ more workers. But it does make the rich even richer, and isn’t that the whole point?

I know it’s totally unfair to point out what happens under the Republican tax bill in 2027 after the individual cuts expire. After all, Republicans say they don’t want them to expire, and we should all pay attention to what Republicans say rather than what they actually do. But I’m just an old dinosaur who thinks actions are more important than words. And regardless of what they may want in the secret recesses of their hearts, the bill they’re about to pass does this:

As the top chart shows, within a decade tax rates will go up for everyone making less than $55,000 and stay about the same up to $225,000. They’ll go down for everyone above that level, and they’ll go down the most for millionaires. This one is from the Tax Policy Center.

On the bottom, you can see how this affects households. Up to $75,000, households will pay several hundred dollars more each year in taxes. Those making over a million dollars per year will pay about $14,000 less. This is from the Joint Committee on Taxation.

But it doesn’t matter. These are the same numbers we’ve seen all along, and the fact that the middle class is getting screwed in service to tax cuts for the rich isn’t going to stop anyone. I sure hope Republicans pay a price for this almost unfathomable act of political cynicism.

Christmas in California #1. Location: Crow Village, Stanton.

The Heads of State

I see that our story about Climategate is now online. You should read it! Here’s why Climategate is worth revisiting:

“If you were a Russian operative [and] pitching influence ops for the DNC, and somebody’s like, ‘Eh, I don’t know about that,’ literally you just turn around and go, ‘Look at how well it worked [with Climategate],’” former National Security Agency analyst Jake Williams tells Mother Jones in our new feature story about the parallels between the two hacks. “I wouldn’t necessarily say one influenced the other, but certainly it’s good proof that that’s a technique that works.”

It is, in fact, remarkable how strong the parallels are between the email hacking at the heart of Climategate in 2009 and the email hacking at the heart of Russiagate in 2016. It’s well worth refreshing your memory on Climategate, since it appears to be an early prototype for a kind of ratfucking that promises to get even more popular in the age of social media.

The story is here. Read it!

Remember Donald Trump’s promise to keep American jobs in America? Of course you do. No longer will we tolerate American companies sending jobs offshore thanks to stupid tax laws and unfair competition. Not on Trump’s watch, anyway.

Funny thing about that. According to the Washington Post, the Republican tax bill is likely to increase the movement of jobs and profit overseas:

There are three reasons, according to nonpartisan tax experts. First, a corporation would pay that global minimum tax only on profits above a “routine” rate of return on the tangible assets — such as a factory — that it has overseas. So the more equipment a corporation has in other countries, the more tax-free income it can earn. The legislation thus offers corporations “a perverse incentive” to shift assembly lines abroad, says Steve Rosenthal of the Tax Policy Center.

Second, the Senate bill sets the “routine” return at 10 percent — far more generous than would typically be the case….As a result, a U.S. corporation that builds a $100 million plant in another country and makes a foreign profit of $20 million would pay roughly $1 million in tax versus $4 million on the same profits if earned in the United States, says Rosenthal, who has been a tax lawyer for 25 years and drafted tax legislation as a staff member for the Joint Committee on Taxation.

Finally, the minimum levy would be calculated on a global average rather than for individual countries where a corporation operates. So a U.S. multinational could lower its tax bill by shifting profits from U.S. locations to tax havens such as the Cayman Islands.

….Companies also are likely to continue to locate valuable intellectual property overseas to pay a lower rate than what they would face in the United States, likely to be around 20 percent, analysts said. “The plan does not meaningfully reduce the incentives for companies to move their operations and shift their income overseas,” [says Rebecca Kysar, a professor at Brooklyn Law School]. “You could say it will make things worse.”

Terrific. This should come as no surprise, since the tax bill is designed to appeal to rich business owners who are in favor of offshoring production if it will make them more money. Still, you have to wonder. Has Trump yet done anything that’s likely to materially improve the job prospects of working and middle-class folks? I can’t think of anything.¹

¹Demolishing environmental rules doesn’t count. That’s popular with big business, but it’s unlikely to do anything for workers.

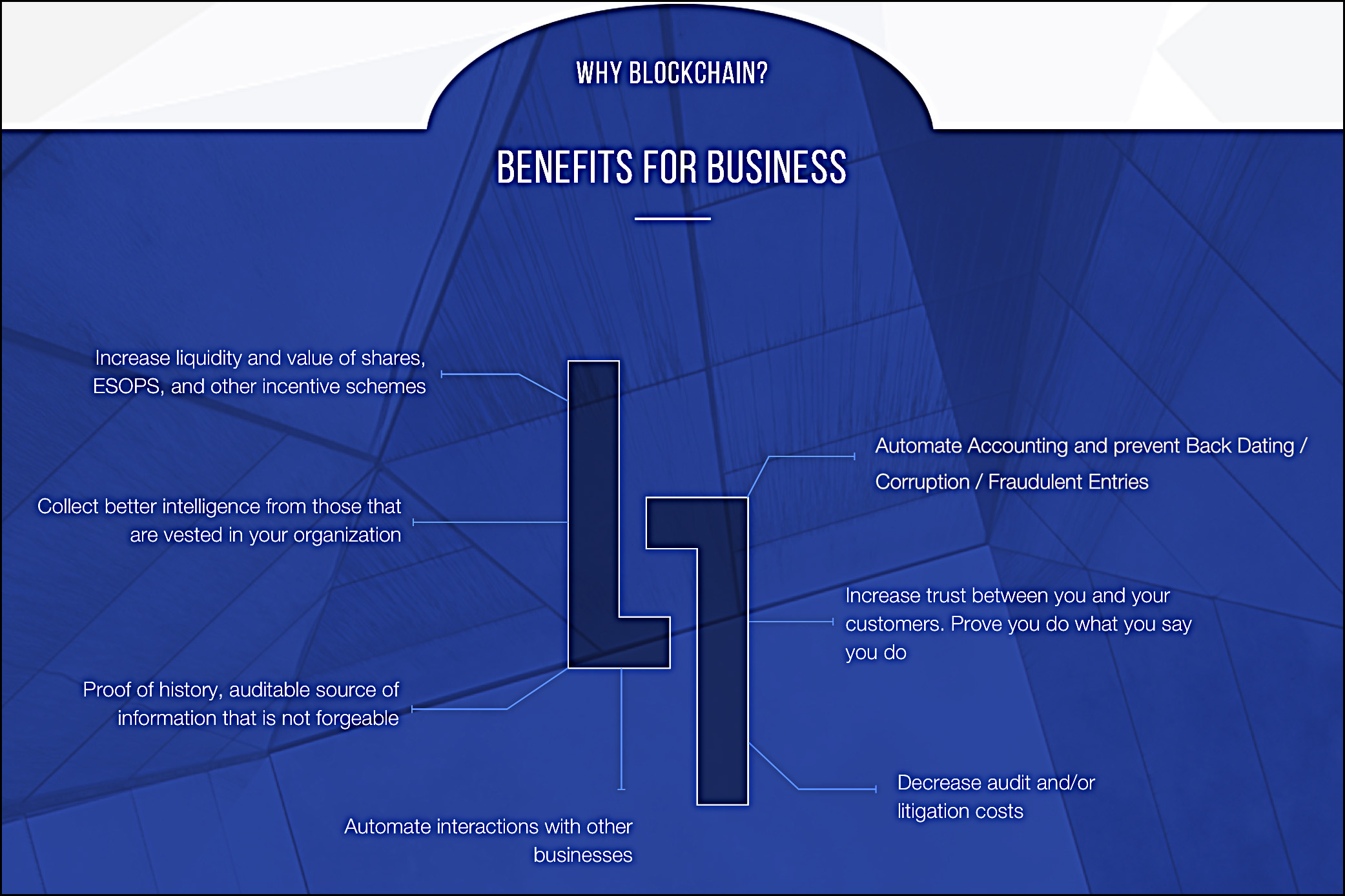

I am, obviously, out of touch with the bold new world of cryptocurrencies. According to the Wall Street Journal today, the biggest initial coin offering of the year is for EOS, which, it turns out, is not a coin at all. It’s not clear if EOS is even a product. Rather, it’s the open-source brainchild of block.one, which says that it “provides end-to-end solutions to bring businesses onto the blockchain from strategic planning to product deployment.” Here’s the elevator pitch:

Whatever. But back to EOS. What is it? Answer: it is an “operating system-like construct.” Will block.one be selling EOS? Answer: no, it will be released under an open source software license. After that, third parties can go to town on it. And what does EOS stand for? Answer: “We believe that EOS means different things to different people. We have received numerous amazing interpretations of what EOS stands for or what it should stand for so we have decided not to formally define it ourselves.”

So far this sounds like a parody. But it’s perfectly real, and it’s funded not by normal venture capital or anything else that gives investors any rights, but by the daily sale of tokens that are, explicitly, worthless: “The EOS Tokens do not have any rights, uses, purpose, attributes, functionalities or features, express or implied, including, without limitation, any uses, purpose, attributes, functionalities or features on the EOS Platform.” And just in case this disclaimer isn’t enough, you can’t buy them in the United States and block.one itself is registered in the Cayman Islands. Why take chances?

The Journal says block.one has raised $700 million this year and has a market cap of $4.5 billion. What they don’t say is that this is actually a market cap of 6.3 million Ethereum, which is allegedly worth about $4.5 billion. No actual dollars or yen or euros have changed hands here. So to summarize:

Even in the heyday of pre-crash CDOs and synthetic CDOs and all their demon spawn, derivatives all had at least a notional connection to a real income stream of some kind. But EOS appears to be valueless all the way down. If this isn’t the behavior of a bubble, I don’t know what is.

German Lopez channels the conventional wisdom:

The past year of research has made it very clear: Trump won because of racial resentment https://t.co/ozBxkOmT7S

— Vox (@voxdotcom) December 15, 2017

Technically, this is true. A number of different studies have shown that the strongest predictor of a vote for Donald Trump was racial resentment.

But in real-world terms these studies are meaningless. Racial resentment has been a growing predictor of votes for every Republican candidate for the past couple of decades. Donald Trump may have tried hard to move that needle, but there’s not a lot of evidence that he did. That leaves us with cruder measures that are frustratingly imprecise. Take a look at the white vote since 1992, for example:

Bill Clinton was the last Democrat to have much appeal to white voters. Since 2000, whites have ticked the box for Republicans at about the same rate in every election. Trump, in fact, did a little worse than Mitt Romney in 2012.

On the other hand, Trump did considerably better than Romney with white working-class voters. Unfortunately, this is hard to assess as well, since Republicans have been steadily increasing their share of the white working-class vote for the past five elections. As with the racial resentment correlations, the question is whether Trump helped drive this upward trend, or merely benefited from it? Since racial resentment among white men hasn’t changed much in decades, most likely it’s the result of increasing partisan polarization, something that Trump had nothing to do with.

As it happens, there is some evidence that racial resentment partially drove the results in a few specific places. The absolute numbers are small, but potentially pivotal given the oddities of the Electoral College. It’s also unquestionably true that Republicans as a whole demonstrated a surprisingly high tolerance for a candidate who was far more explicitly racist, sexist, and xenophobic than any in recent memory. That was disheartening, but it’s not evidence that racism actively drove the results of this election any more than previous ones.

Keep in mind that Trump actually did a little worse than models predicted based on fundamentals. This suggests that racism didn’t have an outsize effect in 2016. It had roughly the same dismal effect it’s always had. What’s more, if James Comey hadn’t released his infamous letter eleven days before the election, we wouldn’t even be talking about this. The fact that Comey did, in fact, release his letter, leading to Trump’s unexpected win, is hardly a good reason to not only hold this endless discussion, but to insist that it’s been settled.