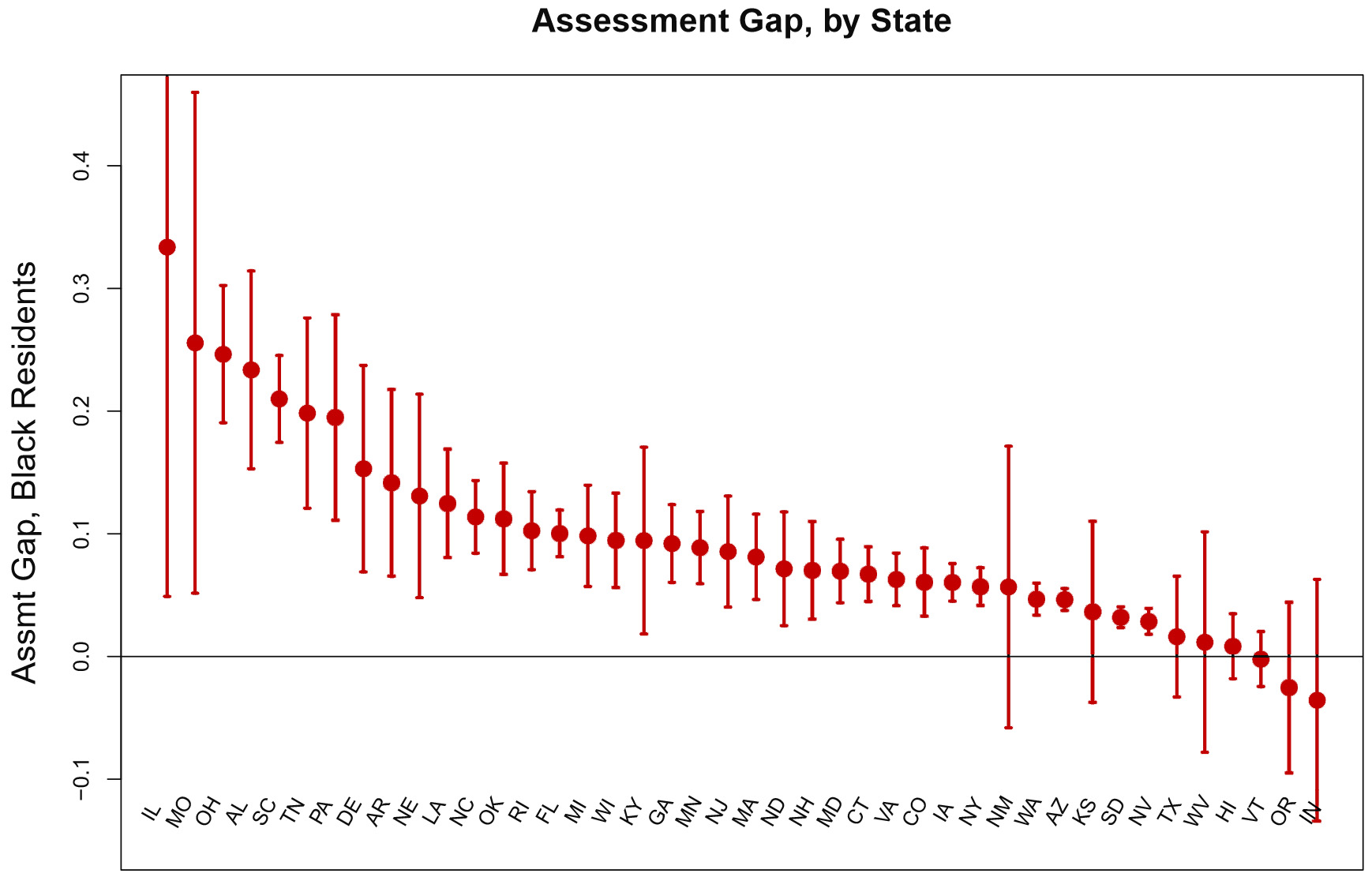

A new paper examines property tax assessments in every state and concludes that Black homeowners pay, on average, a 10–13% higher tax burden “for the same bundle of public services.” Here’s the tax gap state by state:

In Illinois, Black homeowners pay nearly a third more than white homeowners for otherwise similar houses. Among the states studied, only three—Vermont, Oregon, and Indiana—fail to show a pattern of over-assessing Black homeowners.

The authors propose two mechanisms for the tax gap. First, property tax assessments do a good job of assessing value based on house characteristics—age, size, number of bedrooms, etc.—but do a poor job of assessing value based on neighborhood characteristics. Market prices generally do a good job of reflecting the kind of neighborhood a house is in, but property tax assessments tend to diverge from market prices—and they diverge more the greater the number of Black families are in a neighborhood.

The second mechanism is more speculative, but the authors suggest that it has to do with appeals: Black families are less likely to appeal their assessments, and less likely to win an appeal if they do.

This is a good example of structural racism. The mechanisms at work here are not necessarily due to personal racism since, as the authors note, “most assessors likely neither know, nor observe, homeowner race.” Rather, it’s been built into the property tax system for decades and has become nearly invisible. But invisible doesn’t mean nonexistent. Even if it’s not easy to see, it’s still there.