The Treasury Department released yesterday the latest monthly data for its flagship homeowner relief program—and it’s not pretty. So far, in the 14-month-old Home Affordable Modification Program, just under 300,000 homeowners have received permanent modifications to their mortgages—that means lower payments for a three- to five-year period for the homeowner to try to keep them in their home. Those modifications, however, are dwarfed by the pool of delinquent borrowers deemed by Treasury as eligible for HAMP, numbering 1,702,134. (For a bit of context, there were 2.8 million foreclosures in 2009.)

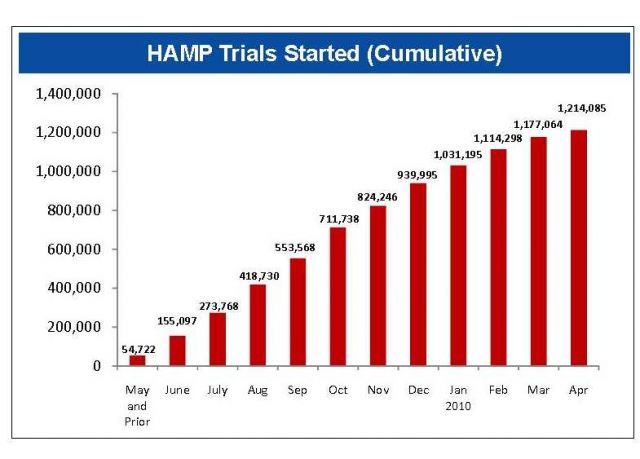

What’s more telling is this graph, via Calculated Risk, that shows the pace of new trial modifications—the testing period for homeowners to prove they can stay current on their theoretically lowered payments—is noticeably slowing down. In September 2009, HAMP recorded nearly 135,000 new trial modifications; in April 2010, there were 37,021 modifications. The graph below shows that this decline has been underway since the beginning of 2010.

Bill over at Calculated Risk draws this conclusion about HAMP, a much maligned program whose problems I’ve been writing about for nearly a year:

If we look at the HAMP program stats (see page 5), the median front end DTI (debt to income) before modification was 44.9% – up slightly from 44.8% last month. And the back end DTI was an astounding 80.2% (up from 77.5% last month).

Think about that for a second: over 80% of the borrowers income went to servicing debt. And it is over 64% after the modification. Do they have a life?

Just imagine the characteristics of the borrowers who can’t be converted!

In summary: 1) the program is dying, 2) the borrowers DTI characteristics are poor – and getting worse, and 3) there are a large number of borrowers in modification limbo.