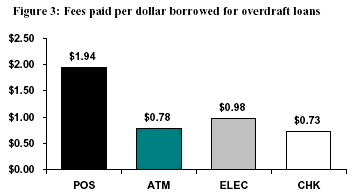

Via Felix Salmon, this chart shows how much overdraft charges cost you. The bar on the left (labeled POS) is from point-of-sale debit card overdrafts.  Here are the numbers: the average overdraft is $17, it’s paid back in an average of five days, and the average charge is $35. Result: you’re paying $1.94 for every dollar “borrowed.” You’d probably need scientific notation to figure out the APR.

Here are the numbers: the average overdraft is $17, it’s paid back in an average of five days, and the average charge is $35. Result: you’re paying $1.94 for every dollar “borrowed.” You’d probably need scientific notation to figure out the APR.

When debit cards first came into common use, they promised the convenience of a credit card without the cost, because debit card users were required to have the funds in their account to cover their purchase or withdraw cash. As recently as 2004, 80 percent of banks still declined ATM and debit card transactions without charging a fee when account holders did not have sufficient funds in their account. But banks now routinely authorize payments or cash withdrawals when customers do not have enough money in their account to cover the transaction, so debit cards end up being very costly for many account holders.

Italics mine. This is just so you understand how deliberate this strategy is. The banks could easily decline NSF transactions. They used to. But they don’t anymore because the fees from inadvertant overdrafts are so lucrative. Alternatively, they could charge reasonable fees, since the actual administrative cost of overdrafts is minuscule these days. But they don’t.

And who pays these fees? Small account holders with modest incomes, of course. That’s the modern banking industry for you.