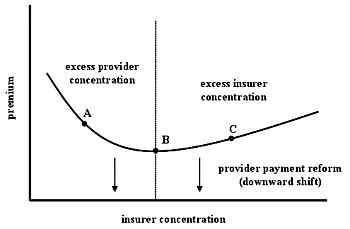

You’ve heard of the Laffer Curve? Today we get the Frakt Curve, courtesy of Austin Frakt, who suggests that trying to increase competition in the healthcare insurance market might reduce costs, but it might not. It all depends on where we are on the curve:

You’ve heard of the Laffer Curve? Today we get the Frakt Curve, courtesy of Austin Frakt, who suggests that trying to increase competition in the healthcare insurance market might reduce costs, but it might not. It all depends on where we are on the curve:

[When insurer concentration is high] premiums are above the minimum possible level. Insurers are charging above the competitive premium level because they have excessive market power. In this region, higher premiums stem from higher insurer profits and/or lack of administrative efficiency….

[When insurer concentration is low] premiums are again above the minimum because insurers can’t negotiate down to the lowest possible price with providers. Providers have too much power relative to insurers and are charging prices above the competitive minimum. Insurers pass those high prices onto consumers through higher premiums. In this case, higher premiums stem from higher medical costs.

Austin’s point is that to a large extent the healthcare battle is waged between insurers and providers. Since the American healthcare system relies primarily on both private providers and private insurers (and this will be true even if a public option passes), we don’t necessarily get the lowest costs when one side or the other is weakened, but when the two sides are fairly equally matched. Thus, removing antitrust protection for insurers might lower costs or it might not. It all depends on where we are on the curve right now.

Alternatively, we can try to move the entire curve downward. Or we could ditch the whole thing and ask the Swedes to please design us a new healthcare system. But in the absence of either of those things, where you are on the curve dictates whether and how much you need to rein in one half of the healthcare market vs. the other.

UPDATE: Michael Hiltzik makes the case for more insurance industry competition here.