Stuart Staniford takes a look at global oil production figures as a proxy for economic growth and comes away unhappy:

Stuart Staniford takes a look at global oil production figures as a proxy for economic growth and comes away unhappy:

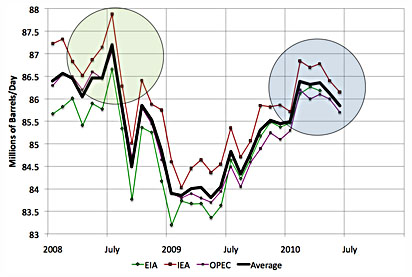

In the short term, global oil production is a sensitive indicator of the state of the global economy, and I’m not aware of any other publicly available proxies for the overall state of the world’s economy that are as timely.

In this case, given that prices are falling rather than rising, and that OPEC undoubtedly has some spare capacity, the question becomes one not about whether supply is struggling to rise, but rather about whether demand is faltering or even declining.

Whether this presages a renewed contraction in the global economy, a stagnation, or just a transient hiccup in the ongoing recovery, I’m not certain of yet. But certainly each passing month of lower oil production will add to the concern.

Are there any economic indicators that look healthy right now? Not that I can think of. Corporate profits are up, of course, as are Wall Street salaries, but that’s small comfort to those of us in the non-millionaire class. Most core indicators are, at best, stagnant, while others are downright gloomy. This one is in the latter category.