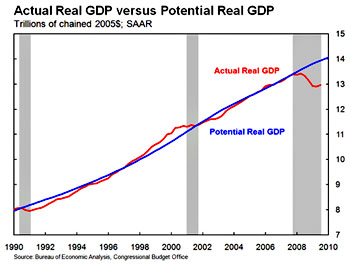

The financial crash of 2008 has produced lots of grim looking charts, and Neil Irwin has another one today. It shows our current output gap: the difference between where the economy is and where it would be if growth had been normal. At the far left you can see the positive output gap of the late 90s followed by a negative output gap during the ensuing recession. That’s fairly normal.

What we have now isn’t. The economy didn’t overheat during the aughts. It was running at its usual historical rate. So the financial crash opened up a huge gap, and it’s one we’re not closing. If the economy grows at 6% a year — far higher than its current rate — unemployment wouldn’t reach normal levels until 2012. If growth averages 3% a year, unemployment won’t reach normal levels until 2020.

That’s a long time to wait. If we want unemployment to come down any time soon, we need sustained economic growth of 4-5% per year for the next five years. Unfortunately, right now we’re not doing anything to get us there. Neither Congress nor the Fed is willing to take any kind of serious action. So we’re stuck. At the rate we’re going now, we’re staring at high unemployment rates for the better part of another decade.