I want to thank Ezra Klein for reminding me about this passage in Politico’s postmortem on the failure of the supercommittee to reach an agreement. It’s a description of the “wish lists” from each side:

House Republicans wanted to repeal Obama’s health care law, implement the controversial House GOP budget drafted by Rep. Paul Ryan (R-Wis.), save $700 billion by block granting Medicaid, cut $400 billion in mandatory spending, slash another $1.4 trillion in other health care mandatory spending, save $150 billion by slicing the federal workforce and put a $60 billion cap on tort reform.

Republicans were no more pleased to see what Democrats wanted: the president’s $447 billion jobs bill plus well over $1 trillion in new taxes.

Right. Toss in the extension of the Bush tax cuts, which Politico leaves out for some reason, and you’ve got $3.7 trillion in tax cuts in addition to repealing Obamacare, making massive cuts in domestic spending, and adopting Paul Ryan’s scorched earth budget blueprint.

Democrats, by contrast, agreed up front to a $3 trillion deficit reduction package but wanted it divided into roughly two-thirds spending cuts and one-third tax increases. Plus a jobs bill since, you know, unemployment remains sky high.

Do these two lists sound roughly similar to you? Of course not. They aren’t even from the same galaxy. The Republican list is a conservative wet dream. It’s not even remotely a starting point for negotiation. By contrast, the Democratic list is a bog ordinary opening bid.

Ezra calls this an example of “asymmetrical polarization.” That’s a new term for me. I call it “negotiating with fanatics.”

then again, he doesn’t usually make flat-out veto promises either. So maybe this time is different.

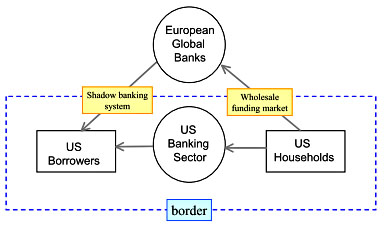

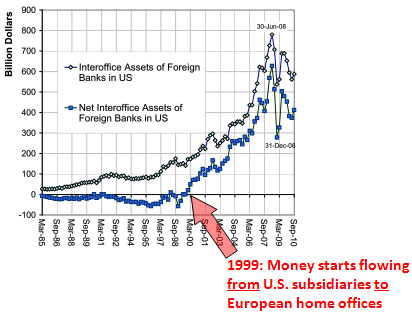

then again, he doesn’t usually make flat-out veto promises either. So maybe this time is different. total, European banks had about $5 trillion in claims on U.S. counterparties in the peak year of 2007, much of it via purchase of private label subprime securitizations.

total, European banks had about $5 trillion in claims on U.S. counterparties in the peak year of 2007, much of it via purchase of private label subprime securitizations. European banking sector provides about as much credit to the U.S. as the American banking sector does. So when the European banking sector deleverages, as it must, it will have a very substantial effect on credit conditions in the U.S. In Shin’s bland phrasing, “The European crisis carries the hallmarks of a classic ‘twin crisis’ that combines a banking crisis with an asset market decline that ampli?es banking distress….The global ?ow of funds perspective suggests that the European crisis of 2011 and the associated deleveraging of the European global banks will have far reaching implications not only for the eurozone, but also for credit supply conditions in the United States and capital ?ows to the emerging economies.”

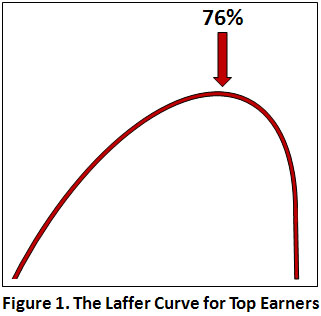

European banking sector provides about as much credit to the U.S. as the American banking sector does. So when the European banking sector deleverages, as it must, it will have a very substantial effect on credit conditions in the U.S. In Shin’s bland phrasing, “The European crisis carries the hallmarks of a classic ‘twin crisis’ that combines a banking crisis with an asset market decline that ampli?es banking distress….The global ?ow of funds perspective suggests that the European crisis of 2011 and the associated deleveraging of the European global banks will have far reaching implications not only for the eurozone, but also for credit supply conditions in the United States and capital ?ows to the emerging economies.” underground. Using parameters based on the literature, D&S suggest that the optimal tax rate on the highest earners is in the vicinity of 70%.

underground. Using parameters based on the literature, D&S suggest that the optimal tax rate on the highest earners is in the vicinity of 70%.