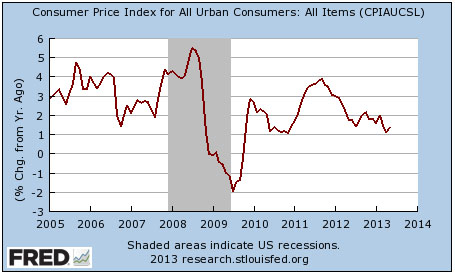

The BLS reported today that inflation is now running wildly out of control! It jumped from 1.1 percent in April to….1.4 percent in May. Obviously  this means we need more austerity.

this means we need more austerity.

Or so the wise men and the conservative shills, allied as usual when it comes to monetary and fiscal policy, will tell us. Matt Yglesias provides the antidote:

If we had 2.3 percent core inflation and 2.6 percent headline inflation, then there’d be a real reason to tighten monetary policy. Given the high unemployment rate, there’d also be a reason to resist that pressure to tighten. But we’re not 0.3 percentage points above the inflation target, we’re 0.3 percentage points below the inflation target [he’s talking here about core inflation, which came in at 1.7 percent in May]. Even if the unemployment rate were dramatically lower, tighter money would still be perverse.

With joblessness high and inflation low, the right policy is clear—easier money, not tighter.

Someday inflation will be persistently above 2 percent. At that point, we can all argue about whether that’s the right target and whether we need to take action to get back under it. But that day is not today. Right now, we’ve been under our inflation target consistently for the entire past year. It’s not something to worry about. Unemployment is.