Via Andrew Sullivan, Chris Dillow points us toward a weird experiment in a fourth-year finance class at the Autonomous University of Barcelona. One student flipped a coin five times and a group of 20 students predicted heads or tails for each toss. Then a second group of students was told that there would be another set of five coin tosses. The best and worst guessers from the first group would try their luck again, and everyone in the second group would earn money for each coin flip that the worst guesser got right.

But there’s more! If students in the second group were willing to pay for the privilege, they could instead earn money for each coin flip that the best guesser got right. There’s no reason to do this, of course, since guessing is just guessing. Nonetheless, 82 percent of the students paid to switch to the better guesser.

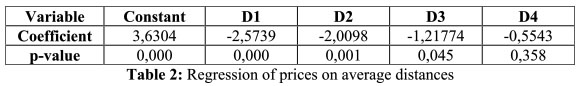

But there’s even more! Just to add some baroque complexity to the whole thing, students in the second group had to say beforehand how much they’d pay to switch from the worst guesser to the best guesser, and they had to provide a different payment depending on how good the guessers were. For example, maybe you’ll pay one euro to switch to a guesser who outpredicted the worst guesser by two flips, but you’ll pay two euros to switch to a guesser who outpredicted the worst guesser by three flips. Then the best and worst guessers were introduced, along with their guessing records, and the professors employed yet another baroque method to decide which students were allowed to switch. Apparently they did this solely to get a matrix of prices from the students. Here’s what they got:

Sure enough, students were willing to pay more depending how much better the top guesser was compared to the worst guesser. So what does this all mean? Here are some guesses:

- Fourth-year finance students in Barcelona have no clue about the independence of coin tossing events.

- FYF students like to play mind games with their professors.

- FYF students believe in telekinesis.

- FYF students believe in supernatural forecasting abilities. (N.B. This would explain much Wall Street behavior.)

- FYF students in this class didn’t really understand the experiment.

- FYF students are skeptical sorts and figured there was a trick involved in all this.

- The sample size was too small to be meaningful.

- Something else about the methodology invalidates the results.

Feel free to add your own guesses in comments.