Have you noticed that I’m desperately trying today not to write about the idiotic budget theater currently playing an unlimited engagement at the Capitol Hill Vaudeville Palace? You  haven’t? Well, I am. It’s just too childish and depressing and monotonous to bear.

haven’t? Well, I am. It’s just too childish and depressing and monotonous to bear.

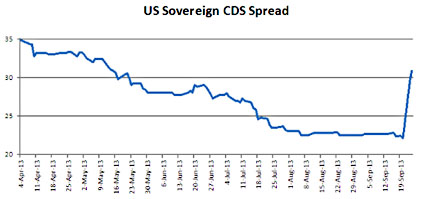

I’m sure I’ll buckle under the strain eventually and write about it again. But not today. I. Will. Be. Strong. In the meantime, Jim Tankersley draws our attention to the chart on the right. I used to hate blog posts called “_____ in One Chart,” but ever since ” _____ in 13 Charts” became the new normal, I actively look forward to posts with only a single chart in them. This one shows the trajectory of the US sovereign CDS spread, which is theoretically a measure of how likely it is that treasury bonds will default. On Monday, it shot up from about 22 basis points to 32 bps.

So what does it mean? Probably nothing. For a variety of reasons, the US sovereign CDS market is very thin, which means this spike could have been the result of just two or three trades. And historically, even 32 bps is pretty low. We’ve seen spikes well above 50 bps several times in the past few years.

Beyond that, of course, it just doesn’t make sense. Even if we have a debt limit crisis, there’s zero chance that holders of treasurys will miss any payments. So what this spike really tells us is probably two things. First, a few people have decided to take out a bet that some other people will panic, allowing them to make some money selling their positions for a quick profit. Second, the CDS markets often don’t tell us much of anything useful. After all, nothing happened on Monday that we didn’t already know on Friday.