Dan Drezner is skeptical about the role of “credibility” in international relations—for example, the proposition that what happens in Syria now has a big impact on what happens in Iran a year from now. Despite this, he believes credibility does matter in domestic politics:

The importance of credibility gets magnified even further when appreciating that [the] same individuals are going to have to go to the bargaining table again and again and again over the next few years. It is in precisely this set of circumstances — in which the bargaining is ongoing and the individual actors don’t change — that one would expect credibility and a reputation for tough bargaining to be pretty

friggin’ important (though I’d really, really like to hear from my American politics colleagues on this question).

I agree, though I’d put it slightly differently. In foreign affairs, it’s very seldom that you see identical scenarios unfold over and over. Everyone accepts that the United States has certain interests, and it’s not hard to recognize that our interests in Syria are somewhat different than they are in Iran. Thus, the fact that we changed course on bombing Syria over a very specific violation of international norms regarding chemical weapons says very little about how we’d eventually react to Iran building a nuclear bomb. Sure, they both involve WMDs in some way, but the similarity ends there. Syrian chemical weapons simply aren’t a big priority for America. Iranian nuclear bombs are. Everyone knows this.

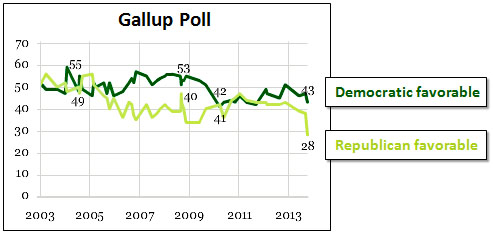

The case of the debt ceiling is precisely the opposite. It’s the exact same scenario every time. If President Obama granted concessions in 2011—which he did—and then grants concessions in 2013 under the exact same conditions, his credibility is unquestionably shredded. There’s simply no doubt that he’ll grant concessions every single time we get close to reaching the debt ceiling. In this case, it really is all or nothing. Obama either has credibility on the debt ceiling or he doesn’t. If he concedes anything at all, his credibility is gone.

Similar situations are very uncommon in international relations. Situations separated in time are almost always different enough that it’s hard to draw any firm conclusions about patterns of behavior, which is why it takes a very long time for credibility to be either established or lost. In domestic affairs, there’s no such fuzziness.

From Jack Lew’s congressional testimony

From Jack Lew’s congressional testimony

Charles Krauthammer, and Marc Thiessen are in this crew. On the other side, we have Republicans who think we should go ahead and raise the debt ceiling and use the government shutdown as leverage for conservative demands. Tea party firebrands Erick Erickson and Matt Kibbe are on this team.

Charles Krauthammer, and Marc Thiessen are in this crew. On the other side, we have Republicans who think we should go ahead and raise the debt ceiling and use the government shutdown as leverage for conservative demands. Tea party firebrands Erick Erickson and Matt Kibbe are on this team. The big news in central banking today is Janet Yellen’s impending nomination to replace Ben Bernanke as head of the Federal Reserve. As lots of people will tell you, she’s fantastically well qualified; she’ll be the first woman to head the Fed; and she’s a monetary dove. (Or an “unemployment hawk” if you prefer.)

The big news in central banking today is Janet Yellen’s impending nomination to replace Ben Bernanke as head of the Federal Reserve. As lots of people will tell you, she’s fantastically well qualified; she’ll be the first woman to head the Fed; and she’s a monetary dove. (Or an “unemployment hawk” if you prefer.) math works out fine for investors; and it provides the federal government with lots of extra money.

math works out fine for investors; and it provides the federal government with lots of extra money.