AIG CEO Robert Benmosche is in trouble for telling the Wall Street Journal that the fight to cut AIG bonuses after the company was bailed out by the federal government was basically the work of a lynch mob, “sort of like what we did in the Deep South [decades ago].” Ezra Klein reviews other similar statements by Wall Street honchos and then explains where it comes from:

I was in an off-the-record meeting with top Wall Street folks where similar comparisons to Nazi Germany were tossed around. It really was a meme on Wall Street that the singling out of the wealthy for criticism — and, more to the point, taxation — had a direct historical precedent in Nazi Germany, where the Jews were first demonized, then taxed, and then, well, you know. The sense was that the rich in general, and Wall Street in particular, weren’t just being criticized, but that they were being turned into a dangerously despised minority.

That’s the context of Benmosche’s comment. I would bet he’s made the same point a number of times in private rooms to appreciative nods. When you say and hear that kind of thing often enough, however, you forget how insane and offensive it is — and then you say it to the Wall Street Journal.

Even Mitt Romney was smart enough to keep this kind of talk private. He was just unlucky that a worker at one of his fundraisers was offended by what he said and decided to release a video of it. Nonetheless, it was pretty obvious that this really was the kind of thing Romney said in private, and the kind of thing that Romney voters ate up.

Likewise here. Wall Street tycoons really do feel put upon. They simply don’t feel any collective responsibility for either the housing bubble or the Wall Street fraud and financial manipulation that made it worse. Nor do they feel any responsibility to support government action that helps ordinary workers who were hurt by the massive recession that followed. Nor do they believe that any further regulation of their activities is warranted in any way. They are the engines of the economy, not rent-seeking mooches, and they’re just damn tired of all the pipsqueaks who think otherwise.

It is truly mind-boggling.

The New York Times reports on a researcher who thinks the traditional explanation for motion sickness

The New York Times reports on a researcher who thinks the traditional explanation for motion sickness  Josh Marshall was at Princeton at the same time as Ted Cruz, but doesn’t remember anything about him. After Cruz won his Senate election last year, he decided to try to

Josh Marshall was at Princeton at the same time as Ted Cruz, but doesn’t remember anything about him. After Cruz won his Senate election last year, he decided to try to

Conservatives have no end to the horror stories they tell about the launch of Obamacare and the impact it will have on the health care market. Most of them, I think, are fairly modest, and many are downright trivial. But for the record, there’s one that I think is going to turn into a sore spot, and today the New York Times

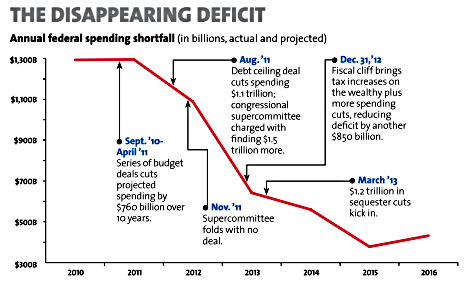

Conservatives have no end to the horror stories they tell about the launch of Obamacare and the impact it will have on the health care market. Most of them, I think, are fairly modest, and many are downright trivial. But for the record, there’s one that I think is going to turn into a sore spot, and today the New York Times  count the expiration of desperately needed stimulus measures like the payroll tax holiday and extended unemployment benefits.

count the expiration of desperately needed stimulus measures like the payroll tax holiday and extended unemployment benefits. problem, and today Chris Wallace asked him about it.

problem, and today Chris Wallace asked him about it.