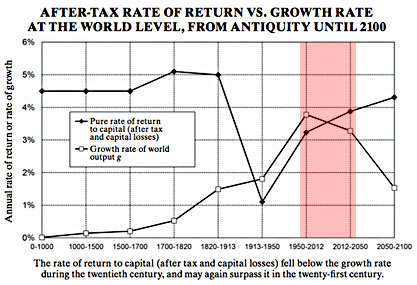

Thomas Piketty is having another moment in the blogosphere. As you may remember, he’s famous for the equation r > g, which states that the rate of return on investments is historically higher than economic growth. This means that rich people with lots of investments get richer faster than the rest of us wage slaves, and this in turn produces growing levels of income inequality.

Is Piketty right? In one of its quarterly polls of economists, the University of Chicago’s Institute on Global Management asked if r > g has been the most powerful force pushing towards greater income inequality since the 1970s. Pretty much everyone said no. Take that, Piketty!

But wait. As Matt Yglesias says, this isn’t evidence that Piketty is wrong. Quite the contrary: it’s evidence that hardly anyone has actually read his book. You see, Piketty doesn’t say that r > g has been a big driver of income inequality in recent years. He says only that he thinks it will be a big driver in the future.

This is good clean fun as a gotcha. But liberals should understand that it also exposes one of the biggest weaknesses of Piketty’s argument: r > g has been true for centuries, but the rich have not gotten steadily richer over that time. Wealth concentration has stayed roughly the same. Piketty argues that this is likely to change starting around 2050 or so, but this is an inherently iffy forecast since it’s several decades in the future. What’s worse, he bases it mostly on a projection that economic growth (g) is shortly going to suffer an  unprecedented fall. This makes his forecast even iffier. Piketty may be right, but projecting growth rates for the second half of the century isn’t something he has any particular expertise in. His guess is no better than anyone else’s.

unprecedented fall. This makes his forecast even iffier. Piketty may be right, but projecting growth rates for the second half of the century isn’t something he has any particular expertise in. His guess is no better than anyone else’s.

Beyond that, there are also serious suggestions that Piketty has improperly measured r. What this all means is that (a) Piketty’s measure of r is questionable because he seems to have conflated gross and net returns and (b) his measure of g is questionable because it’s so far in the future. Other than that, r > g is great.

Making fun of misreadings of Piketty’s book may be good sport, but those misreadings unwittingly raise serious questions. A proper reading suggests that—for now, anyway—r > g as a driver of income inequality should continue to be taken with a grain of salt.