Donald Trump went on CNBC this morning and burbled some Trumpisms about the economy, among them his opinion that Fed chair Janet Yellen should be ashamed of herself for keeping interest rates low in an obviously partisan attempt to help Barack Obama. Matt Yglesias comments:

Versions of this kind of theory are pretty common in business circles, since business circles feature a lot of affluent white men who are generally ill-disposed toward the Democratic Party, but it doesn’t make any sense. After all, the way low interest rates are allegedly helping Obama is by improving economic conditions. But improving economic conditions is what the Fed is supposed to do. Why would they be ashamed?

More technically, the Fed has two mandates: keep employment high and price levels stable. If inflation were high, that might call for higher interest rates to cool down the economy, but in fact inflation is very low. Likewise, if the economy were at full employment, that might permit higher interest rates. But although employment has improved  considerably over the past few years, no one thinks we’re at full employment yet. In other words, the Fed simply has no reason to raise interest rates.

considerably over the past few years, no one thinks we’re at full employment yet. In other words, the Fed simply has no reason to raise interest rates.

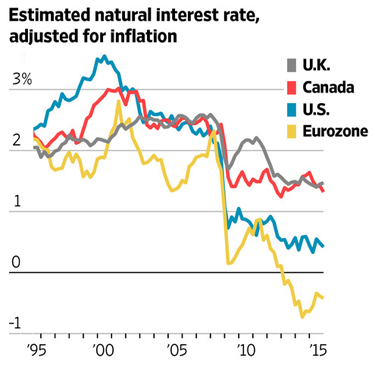

But when conservatives talk about this, they don’t usually talk about the Fed’s legal mandates. Rather, they think the Fed is keeping interest rates “artificially” low, which will have ominous effects any day now. But is that true? What is the market telling us about the natural rate of interest right now? Well, the real rate of interest on AAA corporate bonds bounces around a bit, but at the moment yields are running about 1 percent. In Europe, corporate bonds yields are now negative. John Williams of the San Francisco Fed estimates that the natural rate of interest in the US is currently running at about 0.5 percent. The market is telling us that the natural rate of interest at the moment is very, very low.

So pay no attention to the burbling. The market is telling us that interest rates should be low, and the Fed’s legal mandates are also telling us that interest rates should be low. Janet Yellen is doing just fine.