Remember all that stuff about how Donald Trump’s tax plan treats pass-through income? (Quick refresher here if you don’t.) Apparently the Tax Foundation gave up on getting a straight answer about how this works, so they’re now giving two estimates of the impact of Trump’s plan. If we assume he’s going to keep  the low pass-through rate—the one that would benefit his own businesses—they figure his plan would create a whopping 215,000 new jobs per year over the next decade. And that’s with lots of dynamic scoring pixie dust sprinkled around.

the low pass-through rate—the one that would benefit his own businesses—they figure his plan would create a whopping 215,000 new jobs per year over the next decade. And that’s with lots of dynamic scoring pixie dust sprinkled around.

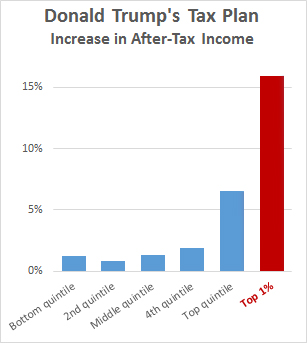

In other words, I think we can safely say that Trump’s plan would create approximately zero jobs. However it would blow a huge hole in the deficit (about $6 trillion without pixie dust) and it would be a huge windfall for the rich, increasing their after-tax income by a whopping 16 percent. And make no mistake: unlike a lot of Donald Trump’s fanciful ideas, a Republican Congress would be delighted to pass something like this. And they’d do it in a way that couldn’t be stopped by a filibuster.

Once again, I get it. This is BORING. It’s policy stuff. Ugh. We really don’t want a bunch of dull numbers like this mucking up our beautiful front pages or our lovingly hand-crafted nightly news programs. That’s why I kept this post short.