Inflation hawks are getting excited again!

U.S. inflation is closing in on the Federal Reserve’s long elusive 2% annual target, the latest evidence of firming price pressures that could bolster the case for the central bank to raise short-term interest rates as soon as this month.

….Headline prices are “almost in line with the Fed’s 2% target” and core inflation is “gradually closing in on that target, which partly explains why Fed officials appear to be making the case for a March interest-rate hike,” said Paul Ashworth, chief U.S. economist at Capital Economics, in a note to clients.

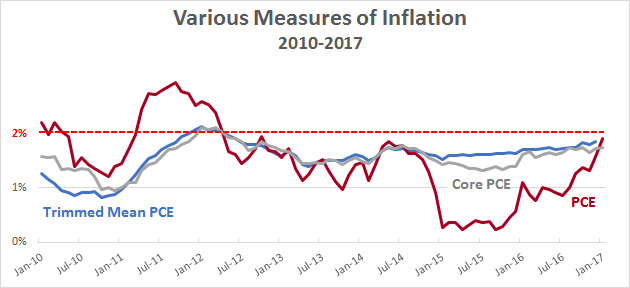

Almost! Just keep in mind that the Fed’s preferred measure of inflation is core PCE, and “gradually closing in” on 2 percent is an understatement. In January 2015 it was 1.41 percent. In January 2016 it was 1.61 percent. In January 2017 it was 1.74 percent. At that rate, it should hit 2 percent by about 2019 or so.

There is evidence that core inflation is rising a bit, inflationary expectations are up, and wages are showing moderate gains, which means the labor market is finally starting to tighten. That said, inflation is still well controlled, one year of wage increases is hardly cause for panic, and the labor market is probably still about a million workers away from being at full capacity. Let’s not get too excited yet.