Last week featured a lovely sunrise to mark the start of the Democratic convention. Fair is fair, so this week features another one. This is “Sunrise Over the Swamp,” which seems appropriate for the GOP convention, I think.

Last week featured a lovely sunrise to mark the start of the Democratic convention. Fair is fair, so this week features another one. This is “Sunrise Over the Swamp,” which seems appropriate for the GOP convention, I think.

Remember this? I guess we were warned.

Hey, remember the poolboy who somehow got an investment from Jerry Falwell Jr. a few years ago for a vaguely defined venture involving a youth hostel? His name is Giancarlo Granda and he now says that ever since he was 20 years old he’s been having an affair with Falwell’s wife, Becki. But was it really an “affair”? According to Granda, “Becki and I developed an intimate relationship and Jerry enjoyed watching from the corner of the room.”

I’m pretty sure the Bible doesn’t condone this sort of thing, but I don’t really care. This isn’t a porn blog, it’s a politics blog.¹ So I’m mostly curious about what Republicans think of all this. Here’s Ari Fleischer, formerly one of George Bush’s press secretaries:

Prediction: The MSM, including NYT reporters on Twitter, will give this story more coverage than Tara Reade’s accusations against Joe Biden. Because that’s the way it works. Accuse a conservative: Get media attention. Accuse a Democrat: The press needs to think about it. https://t.co/bhYz6k16aC

— Ari Fleischer (@AriFleischer) August 24, 2020

Huh. My recollection is that Tara Reade got a mountain of coverage even though her accusations were pretty thin. To find the Falwell story, on the other hand, I had to search the New York Times site because it was nowhere on the front page.

That may change, of course, but my best guess is that the Times and other outlets will give this pretty low-key coverage, though everyone will inevitably finish things up with a 10,000 word, multiple-reporter, graphic-filled feature explaining the entire history of the Falwell clan. (The New Yorker will do 20,000 words.)

That said, how about some actual denunciation of Falwell? I may not care much if Jerry Jr. likes to watch, but supposedly conservatives do. So let’s hear it. Or is Stuart Stevens right?

¹Yes, yes, I know: that’s a thin distinction sometimes.

This is one of my pet peeves, so I beg your indulgence. This is from the Wall Street Journal today:

As the rest of the world struggles to contain the coronavirus, China’s recovery is gaining momentum, positioning it to further close its gap with the U.S. economy….That bounceback, while far from China’s heady expansions of past years, should nonetheless help the world’s No. 2 economy move faster in catching up with the U.S., which could shrink by as much as 8.0% in 2020.

It is also buttressing Beijing’s belief that China’s state-led model, which helped the country navigate the 2008-09 financial crisis with minimal pain, is better than the U.S.’s market system, emboldening Chinese leaders at a time of rising geopolitical competition with the U.S.

It’s common practice to say that China’s economy is #2 in the world, or perhaps even #1 depending on how you do your currency conversions. And it’s true that China’s GDP is about $15 trillion compared to America’s $20 trillion. That’s pretty close, and China is growing faster. Eventually they’ll catch up.

But who cares? It’s like bragging that California has more hospitals than Oregon. Of course it does. California has ten times as many people. In the case of China, what matters is GDP per person, and on that score China is light years behind the US. Here’s the chart you knew was coming:

China’s GDP per person is about $10,000, compared to $65,000 in the United States. They aren’t even in the same ballpark, and it will be decades before they catch up to us—if they ever do.

There are obviously some legitimate reasons to look at overall GDP since it affects things like trade volume and military capacity, but most of the time it seems to be little more than an attempt at drama. For some reason we’re supposed to be afraid that China is going to take over the world, but that looks pretty ridiculous if you look at living standards and GDP per capita. So instead we’re spoon-fed total GDP, even though we almost never do that for any other country. Do you have any idea how Germany’s GDP compares to ours? Or Spain’s? Or Denmark’s? Here’s a hint: they’re a lot lower because they have a fraction of our population.¹ Everyone knows it would be a ridiculous comparison, which is why you never see it.

But when it comes to China, we hear about it all the time. We should knock it off.

¹For the record, roughly $4 trillion, $1 trillion, and $0.3 trillion. Does this tell you anything interesting at all?

The Wall Street Journal reports today that experts are having second thoughts about blunt lockdowns in response to a pandemic like COVID-19:

Prior to Covid-19, lockdowns weren’t part of the standard epidemic tool kit, which was primarily designed with flu in mind….By late March, [epidemiologists] had changed their minds. The sight of hospitals in Italy overwhelmed with dying patients shocked people in other countries. Covid-19 was much deadlier than flu, it was able to spread asymptomatically, and it had no vaccine or effective therapy.

….Sweden took a different approach. Instead of lockdowns, it imposed only modest restrictions to keep cases at levels its hospitals could handle. Sweden has suffered more deaths per capita than neighboring Denmark but fewer than Britain, and it has paid less of an economic price than either, according to JPMorgan Chase & Co. Sweden’s current infection and death rates are as low as the rest of Europe’s, suggesting to some experts the country may be close to herd immunity. That is the point at which enough of the population is immune, due to prior exposure or vaccination, so that person-to-person transmission declines and the epidemic dies out.

The conventional wisdom these days is that Sweden’s moderate approach didn’t work. And it’s certainly true that their death rate from COVID-19 has been pretty high. At the same time, part of their strategy has always been to impose restrictions that people can tolerate for a very long time. This might produce higher than average death rates at first, but it might produce lower than average death rates over a full cycle of the infection, including the second COVID-19 wave expected to come in winter. So the big question is how Sweden will compare to other countries once we’ve been through that second wave.

For this reason, I remain extremely interested in the Swedish approach. It might be a failure, but I don’t think we’ll know for sure until next year.

Here’s the coronavirus death toll through August 23 The raw data from Johns Hopkins is here.

With the Republican convention imminent, President Trump wants some good news. So he bullied the FDA into issuing an emergency approval for a COVID-19 treatment:

Calling it “a truly historic announcement,” U.S. President Donald Trump on Sunday hailed a federal government emergency authorization for use of convalescent blood plasma that he declared would “save countless lives” of coronavirus patients.

Trump and his health secretary, Alex Azar, at a briefing for reporters, noted a 35% decrease in mortality among those younger than 80 who were not on a respirator, a month after receiving the treatment early in the course of their disease. “We dream in drug development of something like a 35% mortality reduction,” Azar, the secretary of Health and Human Services, said alongside the president.

A “senior administration official” expanded on this:

“If you’re one of the 35 people out of a hundred who survive severe COVID symptoms because of convalescent plasma, this is certainly a breakthrough,” the official said.

Ahem. The treatment involves infusing patients with blood plasma from people who have recovered from COVID-19. This is very much a legitimate line of research, but it most certainly doesn’t save 35 lives out of a hundred or anything close to it. I know you count on me for chart-based versions of data like this, so here you go:

Among a subset of seriously ill patients, researchers produced several preliminary results:

Needless to say, none of these are anywhere close to what most people think of when they hear about a 35 percent difference. So where did that come from? Well, if you cherry pick one of the results—7-day high vs. low—and calculate the death rate instead of the survival rate, you get 8.9 divided by 13.7. This equals 0.65, which means the high-plasma group died at a rate 35 percent lower than the low plasma group on a relative basis. This is a number that might be of importance to a researcher or a statistician, but not to anyone else. For the lay public, the basic result is that plasma treatment might improve your survival rate by four or five percentage points.

In other words, the plasma treatment is promising but unlikely to make a huge difference. It’s certainly light years away from “historic” and in no way does it save 35 lives out of a hundred. Four or five is more like it. Nonetheless, Trump implied tremendous results; Azar confirmed it; FDA commissioner Stephen Hahn stayed silent; and a senior administration official then retailed an even more ridiculous version of the whole thing.

None of this was an accident. It was carefully designed to mislead the lay public into thinking that Trump had decisively ripped a miracle treatment out of the hands of the stupid doctors and made it available to everyone. He didn’t. Tens of thousands of people have already received plasma treatment and that will continue with little change. Eventually more careful studies will be done and we’ll have a better idea of just how well this treatment really works. In the meantime, as usual, never listen to anything that Donald Trump says about it.

SMG via ZUMA

From Maryanne Trump Barry, talking about her brother Donald:

He has no principles. None.

I don’t think this is quite true. His guiding principle throughout his entire life has been that if it helps Donald, then it’s OK.

Here’s the coronavirus death toll through August 22 The raw data from Johns Hopkins is here.

A few days ago President Trump said he was “seriously considering” a cut in the capital gains rate if he’s re-elected. Needless to say, Trump says a lot of things, and the fact that he said this probably doesn’t mean much. Still, he was backed up by longtime capital gains warrior Larry Kudlow, who told reporters “We’d like to take it back to 15%, where it was for quite a long time because it helps jobs, investment, productivity and wages.”

Is that true? First off, here’s the amateur view of whether capital gains rates have any effect on economic growth:

Hmmm. It sure doesn’t look like the capital gains rate has much correlation with real GDP growth. If anything, the trend lines are going in the wrong direction entirely: capital gains rates have been declining since 1960, but the only result has been a decline in GDP growth too. If low capital gains rates boost GDP, it sure doesn’t show up here.

But this is just playground stuff. Serious economists have far more sophisticated ways of figuring out if capital gains cuts lead to higher economic growth. So what do they say?

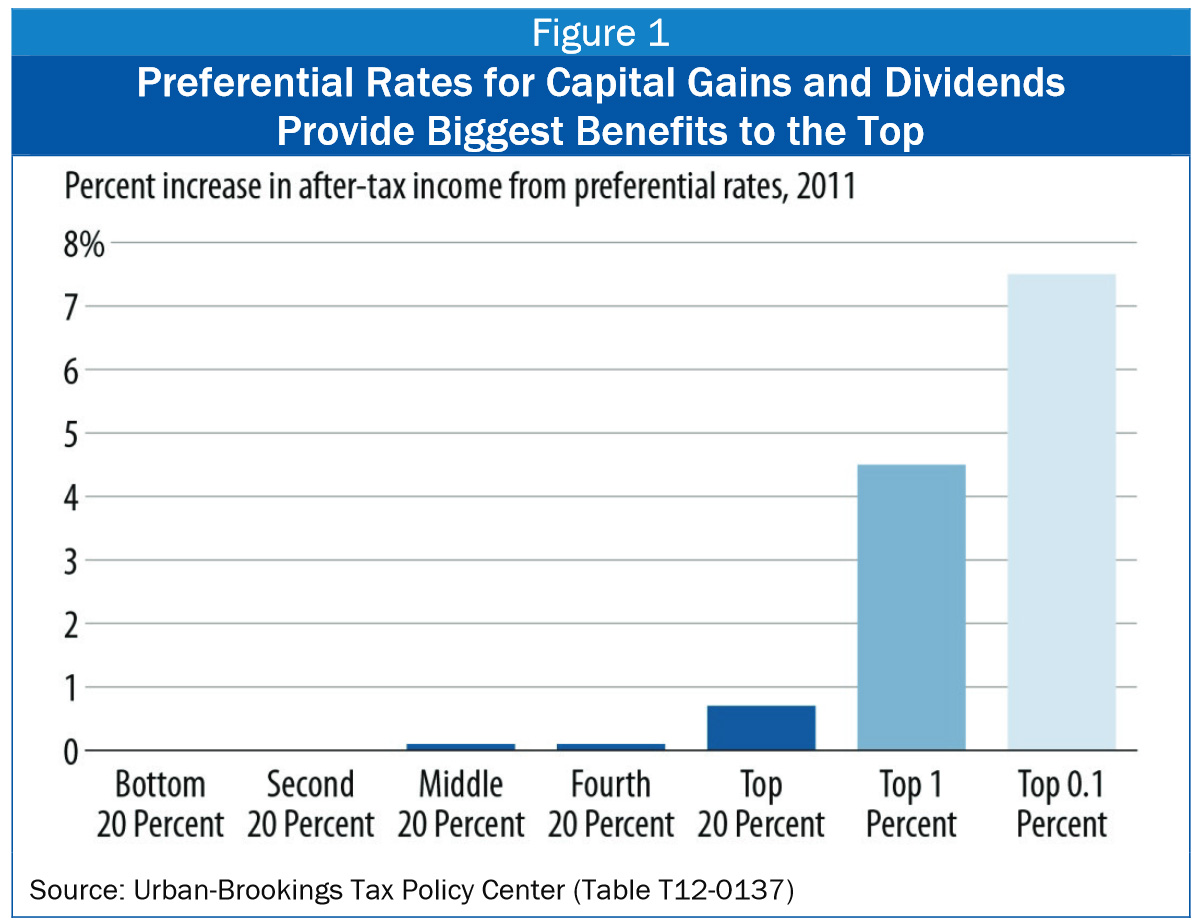

I could go on, but why bother? There’s been a ton of research on this subject and it almost unanimously concludes that capital gains rates have a tiny effect at most on economic growth. On the other hand, when capital gains rates are different from ordinary tax rates they can cause serious mischief:

So that’s that. It’s no surprise that rich people—and therefore the Republican Party—are in favor of reducing capital gains rates. Why wouldn’t they be? But there’s no reason for the other 99 percent of us to be in favor. It does the economy no good; it does us no good; and it motivates lots of inefficient gameplaying with taxes. It’s just another stupid con. Don’t fall for it if your income is anywhere below $200,000 or so.

Here’s the coronavirus death toll through August 21. The raw data from Johns Hopkins is here.