With the situation in the Gulf growing more bleak by the day, Secretary of Interior Ken Salazar pledged on Sunday to “keep the boot on the neck” of BP to fulfill their responsibility in addressing the spill. As the spill gets worse, BP is facing more pressure for the lax safety precautions and inadequate response plans that created a disaster of this magnitude.

Among the top concerns brought to light in recent days: The Deepwater rig lacked a remote-control shut-off switch, a back-up system that would close the well even if the rig above was destroyed. Countries like Norway and Brazil require these precautions to avert catastrophe, but in the US the technology is voluntary. This is thanks to a 2003 decision by the Bush administration’s Minerals Management Service (MMS), which considered mandating them but decided against it under pressure from oil companies, including BP.

The oil companies complained that the $500,000 devices were too expensive. Keep in mind the Deepwater was a $560 million rig. And rather than investing half a million in the safety device that might have prevented this disaster, the company is now spending $6 million a day in clean up costs. And the economic ramifications go far beyond BP; the spill is on a path to destroy fragile coastal ecosystems and the seafood and tourism industries of at least three states, and has required an untold amount of federal, state, and local government resources.

It has also become clear that BP far, far underestimated the possible risks of an accident at the Deepwater rig and overestimated its ability to deal with an accident. BP says the spill is the fault of a defective “blowout preventer” that should have sealed off the well. But reports from MMS also make it clear that there were well-known, substantial problems with the “blowout preventers.” Still, even BP’s “worst-case scenario” for an accident at the site was a release of 162,000 barrels per day, which it said it was prepared to handle in a plan provided to the federal government in February 2009. And as Huffington Post reports, MMS certified at the time that it believed BP “has the capacity to respond, to the maximum extent practicable, to a worst-case discharge, or a substantial threat of such a discharge.” It’s now clear that the company was nowhere near prepared for a spill of this magnitude.

BP now plans to put a dome over the well that would prevent more leakage, but that could take another six to eight days to deploy, and at a mile below the water would be a difficult operation, to say the least. But they had to build the containment vessels after the spill; the company didn’t have them on hand because it “seemed inconceivable” that the blowout preventer would fail. “I don’t think anybody foresaw the circumstance that we’re faced with now,” BP spokesman Steve Rinehart told the Associated Press. “The blowout preventer was the main line of defense against this type of incident, and it failed.”

Even the worst-case scenario may turn out to get even worse in the coming days, reports the Mobile, Ala. Press-Register:

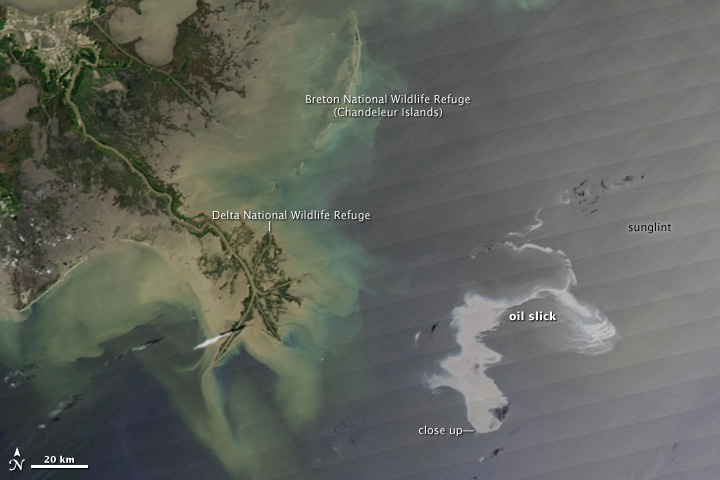

The worst-case scenario for the broken and leaking well gushing oil into the Gulf of Mexico would be the loss of the wellhead currently restricting the flow to 5,000 barrels—or 210,000 gallons per day.

If the wellhead is lost, oil could leave the well at a much greater rate, perhaps up to 150,000 barrels—or more than 6 million gallons per day—based on government data showing daily production at another deepwater Gulf well.

By comparison, the Exxon Valdez spill was 11 million gallons total. The Gulf spill could end up dumping the equivalent of 4 Exxon Valdez spills per week.