The New York Times reports a familiar story:

More than a year into the trade dispute, sales of American soybeans, pork, wheat and other agricultural products to China have dried up as Beijing retaliates against Mr. Trump’s tariffs on Chinese imports.

I was curious about the latest data on soybeans, so I hopped over to the USDA to look it up. I expected to see the usual data showing soybean shipments to China falling off a cliff, but instead I got a surprise:

Soybean shipments did fall off a cliff in 2018, but in 2019 they staged a surprising recovery. If anything, soybean exports to China this year are running a little ahead of their 2017 rate.

Some of this could be due to game playing by the Chinese government, which buys soybeans itself and then resells them to private companies, thus circumventing its own tariffs. Whatever the reason, the actual volume of shipments is now back to normal, or nearly so. However, the price of soybeans, which had been fairly stable since 2016, has declined since the Chinese tariffs took effect, dropping from about $9 per bushel to $8 per bushel. So farmers have definitely taken a hit, but to say that shipments have “dried up” really isn’t right.¹

The story on wheat is a little different:

Wheat shipments really did dry up, but they never amounted to much in the first place. At the same time, both US production of wheat and total US exports of wheat were up in 2018 and 2019, and prices have been steady. Chinese tariffs don’t appear to have had any effect at all on US wheat farmers.

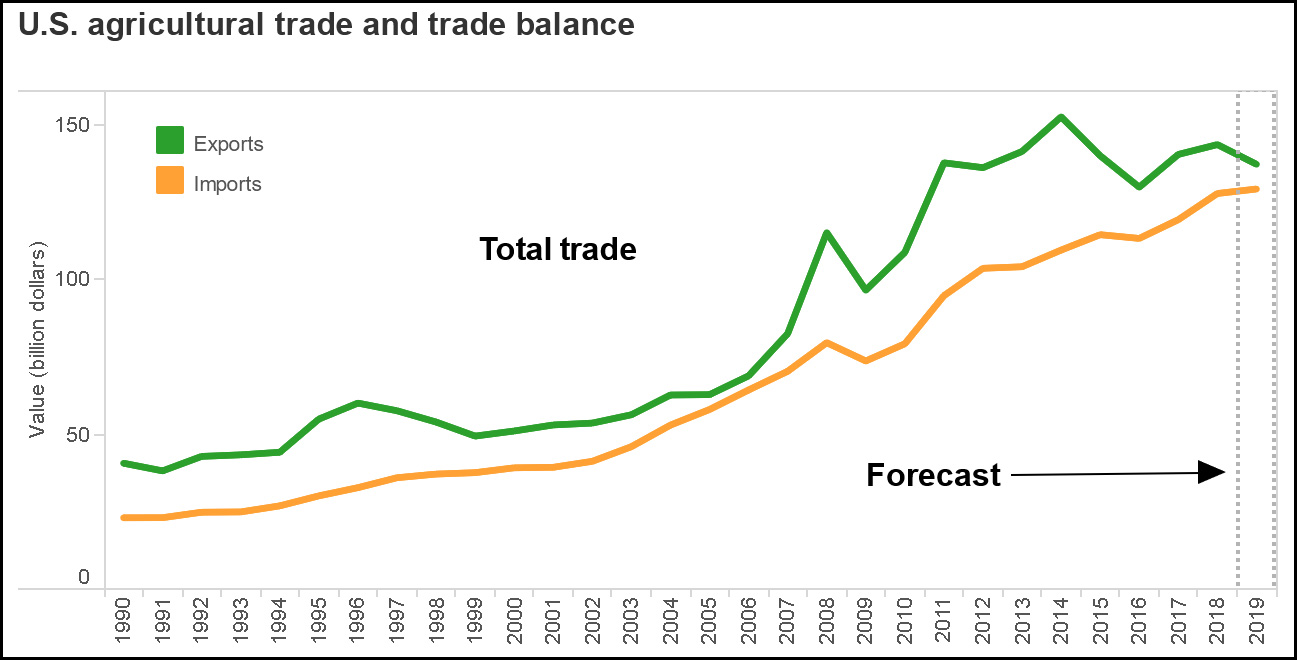

Finally, here’s the USDA’s projection of total agricultural exports:

Beware of farm lobbyists who compare 2019 exports to 2014: they’re just cherry-picking an unusually good year as a baseline. In reality, total agricultural exports were up in 2018 and are projected to decline about 4 percent this year, only a fraction of which is due to China.

¹Needless to say, this could change going forward after China announced new retaliatory tariffs in response to Trump’s increased tariffs from last week.