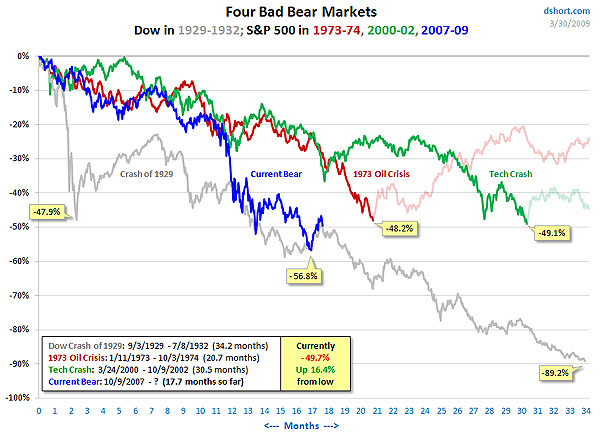

Atrios thinks any optimism about the economy is misplaced. Homes prices are continuing to fall, plus this:

There’s still a big wave of ARM resets* coming, and the CRE implosion has just begun.

*Regarding ARM resets, some suggest this won’t be a problem because interests rates are so low. But the issue is option ARMS (“pick a payment!”) loans, where people have been making interest-only or even neg-am payments on the loans.

For what it’s worth (about what you’re paying for it, I’d say), I agree. Home prices probably have another 9-12 months left to fall, commercial real estate is imploding, rising savings rates are going to continue to depress consumption, and beyond that there’s the rest of the world to think about too. Eastern Europe looks set to collapse sometime later this year, and if/when that happens it’s going to have a huge impact on western European banks. Plus there’s hedge funds. So far they’ve weathered the storm fairly well, all things considered, but I keep waiting for the other shoe to drop on that score.

Anyway, that’s all pretty discouraging stuff. Hopefully we’re both wrong and things are going to start picking up this summer. But I’m afraid I doubt it.