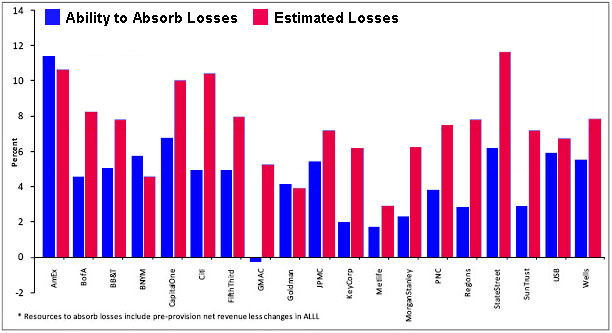

Just for the hell of it, here’s a composite version of the two charts I posted the other day from the stress test report. Basically, for each of the 19 big banks that were tested, it shows estimates of both projected losses under adverse economic conditions as well as the ability to absorb those losses without eating into capital. For example, on the far left, American Express has big expected losses, but also has the capacity to absorb them all via earnings. So, since their capital structure is OK right now, that means it will stay OK and they don’t need to raise money.

Next door, however, is Bank of America. They have big projected losses and only a limited ability to absorb them via earnings. That means their losses will eat into their capital. What’s more, their capital structure isn’t so hot even now. That’s why Treasury is requiring them to raise a huge tranche of new money.

Anyway, as you can see, hardly anybody is in really good shape. Even the banks that have adequate capital and income to see them through the recession are still expected to take sizeable losses. And yet, bank stocks are up, up, up. Go figure. If I didn’t listen to Paul Krugman so much maybe I would have bought 10,000 shares of BAC a couple of months ago and made a killing. Thanks a lot, Paul.