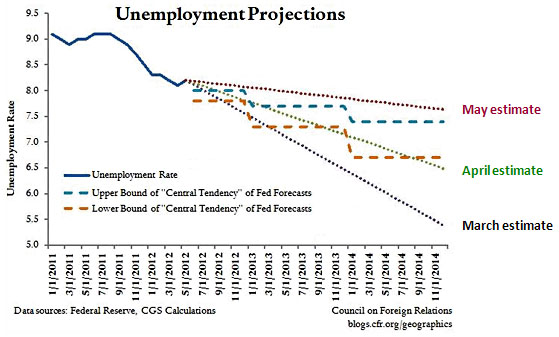

Will the Fed finally decide to loosen up a bit and do something to prop up our fragile economy? Maybe! Brad Plumer points us to this chart compiled by the Council on Foreign Relations that explains why they might. Back in March, the Fed thought unemployment was falling nicely and would reach 6.5% by the end of next year. By May they were far more pessimistic, predicting that unemployment would be only barely below 8% by then. And, as Brad says, that’s not all:

Of course, there’s more than the unemployment rate to consider. Jobless claims have been ticking upward of late. Retail and manufacturing is weakening. The housing market is still flailing along. Plus, Fed officials will have to consider whether Europe still poses a threat to the U.S. recovery. But the [CFR] graph lays the choice out starkly. If the rough patch in May wasn’t just a blip, then the Fed will be failing to achieve its own stated goals for unemployment.

It’s past time for the Fed to do something about this, and it’s not just Paul Krugman saying so. The Fed’s own forecasts are saying it too.