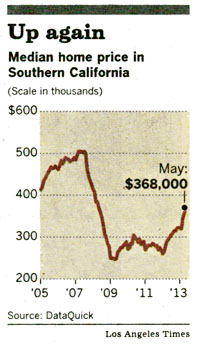

Housing prices nationwide are up, but in most areas we haven’t seen scary kinds of increases. It’s a different story here in Southern California, though, where home prices have risen 25 percent in the past year:

Housing prices nationwide are up, but in most areas we haven’t seen scary kinds of increases. It’s a different story here in Southern California, though, where home prices have risen 25 percent in the past year:

“We’re deep into uncharted territory,” DataQuick President John Walsh said, citing “razor-thin” inventory, pent-up demand, low interest rates and all-cash purchases by investors and wealthy individuals. “How this all plays out is educated guesswork at this point.”

….Extremely low inventory and mortgage rates have ignited those bidding wars and helped turn the housing market into an economic bright spot — both in the Southland and nationwide. Investors have also played a major role in the recovery that began last year, buying run-down, lower-cost properties to fix up and rent out.

Is this a bellwether for the future—and for the rest of the country? Maybe not. Richard Green, director of USC’s Lusk Center for Real Estate, thinks prices will ease later in the year for a simple reason: “Ultimately, people don’t have the income,” he says. That’s cheery news, isn’t it?