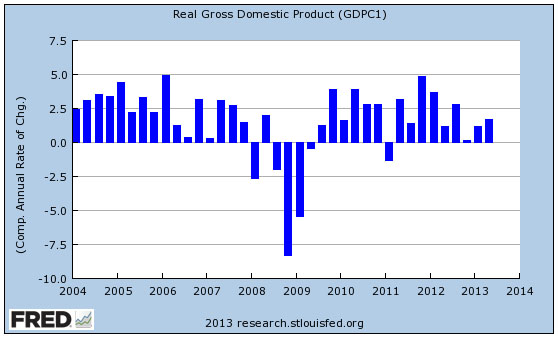

The economy sputtered along in the second quarter, growing at an annual rate of 1.7 percent. Whether you consider this good news or bad probably depends on what you expected the impact of the sequester and the fiscal cliff to be. If you figured that $2 trillion in extra austerity measures would tank the economy completely, then a gain of 1.7 percent looks pretty good. If you figured it would have a modest effect, then 1.7 percent is probably about what you expected.

As I recall, CBO estimated that the sequester alone would cut about 0.8 percent from GDP growth. The fiscal cliff deal might have cut another 0.4 percent or so. If they were right, it means that 2.9 percent growth has been pared back to 1.7 percent. My rough eyeballing of the figures suggests to me that this was probably an overestimate, but probably only by a bit. I’ll bet that without the latest round of austerity, growth would have been in the range of 2.5 percent.

So we’re recovering slowly and austerity is hurting. Beyond that, there aren’t a lot of fascinating nuggets to be gleaned from this quarter’s report. However, this is the first quarter that BEA has produced its long-awaited new measurement of private investment in intellectual property products, and there are some interesting tidbits there. For more on this, see Dylan Matthews’ writeup over at Wonkblog.