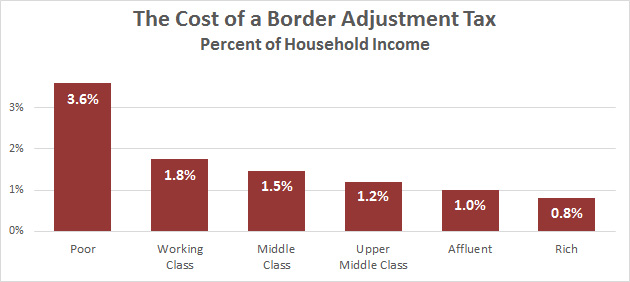

Kadee Russ, formerly a senior economist for the CEA and now a professor of economics at UC Davis, has taken a rough cut at the distributional effects of a border adjustment tax, the front-runner among “sort of a tariff” tax plans currently making the rounds in Congress. A BAT would supposedly raise about $200 billion per year, but raise it from whom? Here’s her estimate:

Isn’t that a shocker? It’s a regressive tax that hits the working class harder than it does the rich. What’s more, the whole point of imposing a BAT is to raise money so that personal income taxes can be slashed on the rich top marginal rates on job creators can be reduced. This whole Trump presidency thing is working out really well for the working class, isn’t it?

TECHNICAL NOTE: Russ calculated the cost of the tax by income decile. I merged her first eight deciles into four quintiles. Click the link to see her original estimates.